Question: Lets focus on the $40-strike put. As we see in the table the trader is offering this option at $0.77, which is an implied volatility

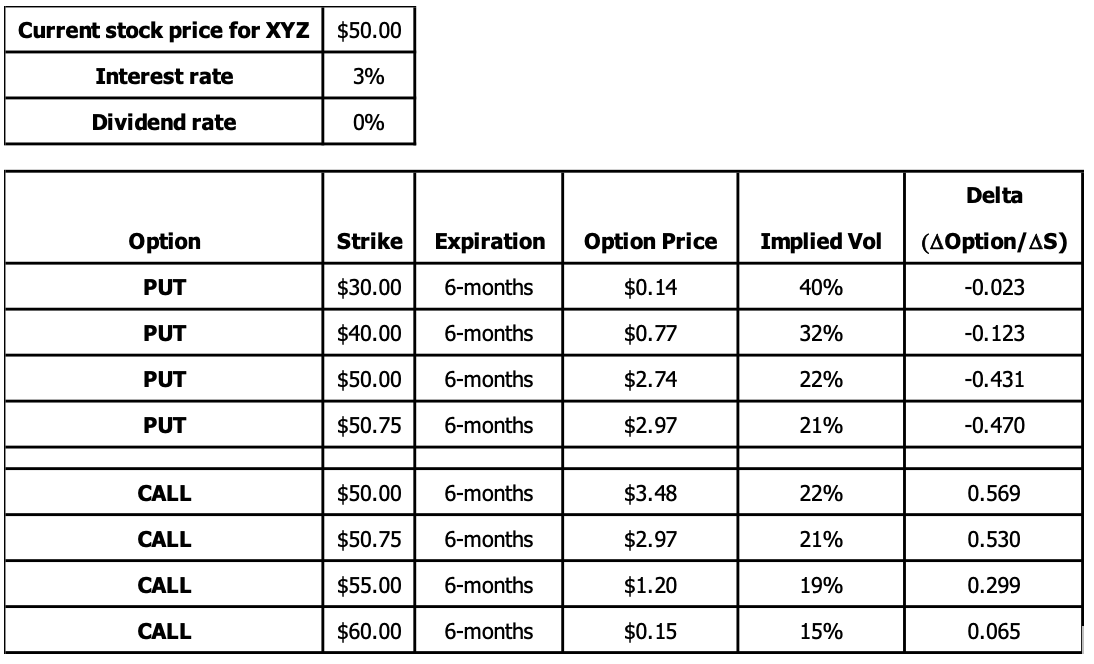

Lets focus on the $40-strike put. As we see in the table the trader is offering this option at $0.77, which is an implied volatility of 32%. At this implied volatility we observe a delta of -0.123. Of course, at 40% implied volatility the price youd be charged is higher. How about the delta at 40% volatility? Would it be more negative or less negative? Explain.

Current stock price for XYZ $50.00 Interest rate 3% Dividend rate 0% Delta Option Strike Expiration Option Price Implied Vol (4Option/AS) PUT $30.00 6-months $0.14 40% -0.023 PUT $40.00 6-months $0.77 32% -0.123 PUT $50.00 6-months $2.74 22% -0.431 PUT $50.75 6-months $2.97 21% -0.470 CALL $50.00 6-months $3.48 22% 0.569 CALL $50.75 6-months $2.97 21% 0.530 CALL $55.00 6-months $1.20 19% 0.299 CALL $60.00 6-months $0.15 15% 0.065

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts