Question: Let's get a little more practice with working backwards on taxes. Vo'll keep making all the same assumptions that we started with in the Pro

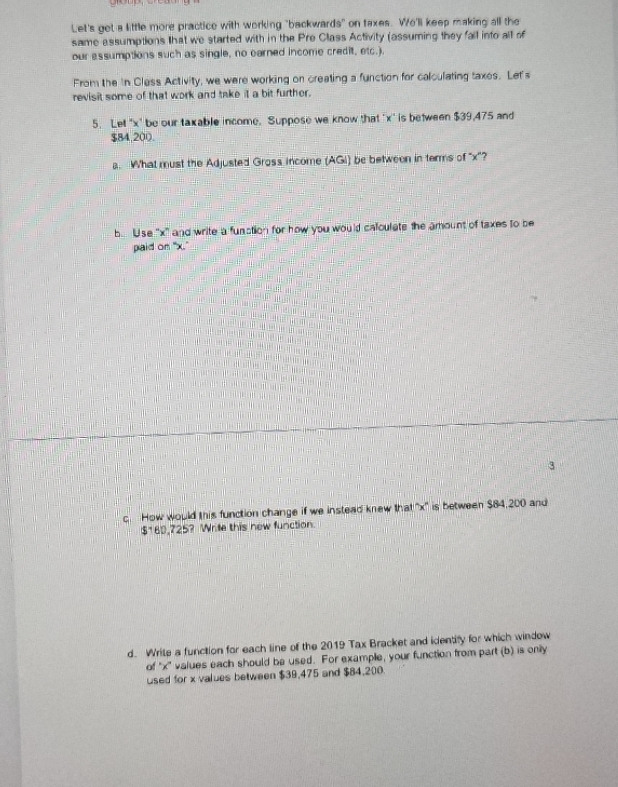

Let's get a little more practice with working "backwards" on taxes. Vo'll keep making all the same assumptions that we started with in the Pro Class Activity (assuming they fail into all of our assumptions such as single, no earned Income credit, etc.). From the In Class Activity, we were working on creating a function for calculating taxes. Let's revisit some of that work and take it a bit further. 5. Let's"be our taxable income. Suppose we know that "x" is between $39 475 and $84,290. Q. What must the Adjusted Gross Income (AGI) be between in terms of "x"? by: Use x and write a funation for how you would calculate the amount of taxes to be paid on 54 How Would this function change if we instead knew thatl x" is between $84,200 and $160,7257 Write this new function. d. Write a function for each line of the 2019 Tax Bracket and identity for which window of 'x" values each should be used. For example, your function from part (b) is only used for x values between $38,475 and $84,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts