Question: Let's Play . . . Cash for Questions! Imagine that you are a contestant on a popular television quiz show, Cash for Questions. You are

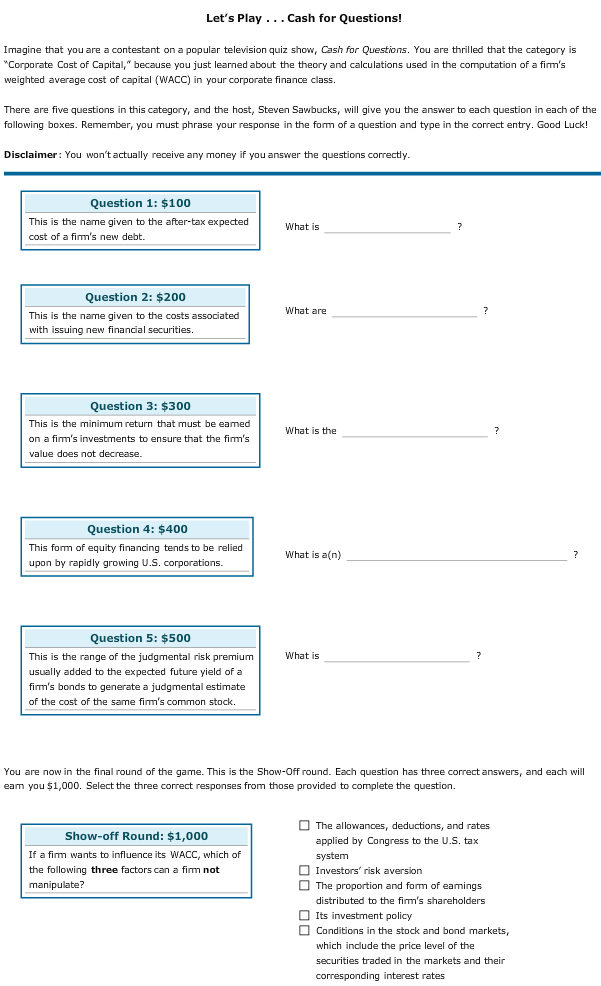

Let's Play . . . Cash for Questions! Imagine that you are a contestant on a popular television quiz show, Cash for Questions. You are thrilled that the category is Corporate Cost of Capital," because you just learned about the theory and calculations used in the computation of a firm's weighted average cost of capital (WACC) in your corporate finance class. There are five questions in this category, and the host, Steven Sawbucks, will give you the answer to each question in each of the following boxes. Remember, you must phrase your response in the form of a question and type in the correct entry. Good Luck! Disclaimer: You won'tactually receive any money if you answer the questions correctly Question 1: $100 This is the name given to the after-tax expected cost of a firm's new debt. What is Question 2: $200 What are This is the name given to the costs associated with issuing new financial securities. Question 3: $300 This is the minimum return that must be earmed on a firm's investments to ensure that the finm's value does not decrease. What is the Question 4: $400 This form of equity financing tends to be relied upon by rapidly growing U.S. corporations. What is a(n) Question 5: $500 What is This is the range of the judgmental risk premium usually added to the expected future yield of a fim's bonds to generate a judgmental estimate of the cost of the same firm's common stock. You are now in the final round of the game. This is the Show-Off round. Each question has three correct answers, and each will ean you $1,000. Select the three correct responses from those provided to complete the question. The allowances, deductions, and rates applied by Congress to the U.S. tax Show-off Round: $1,000 If a firm wants to influence its WACC, which of the following three factors can a firnm not manipulate? Investors risk aversion The proportion and form of eamings distributed to the firm's shareholders Its investment policy Conditions in the stock and bond markets, which include the price level of the securities traded in the markets and their corresponding interest rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts