Question: Let's see just how much high expected inflation can hurt incentives to save for the long run. Let's assume the government takes about one- third

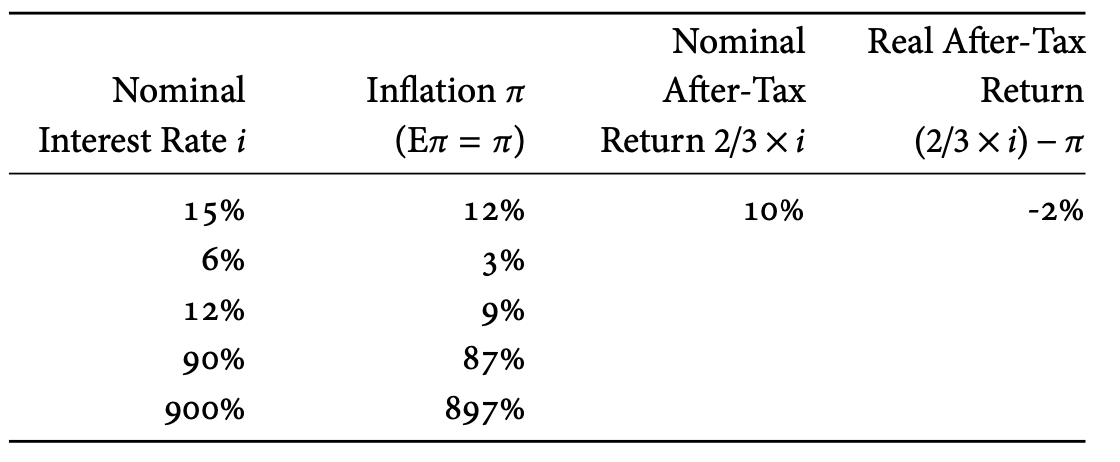

Let's see just how much high expected inflation can hurt incentives to save for the long run. Let's assume the government takes about one- third of every extra dollar of nominal interest you earn (a reasonable approximation for recent college graduates in the United States). You must pay taxes on nominal interest-just like under current U.S. law-but if you're rational, you'll care mostly about your real, after-tax interest rate when deciding how much to save.

To make the economic lesson clear, note that in every case, the real rate (before taxes) is an identical 3%. In each case, calculate the nominal after-tax rate of return and the real after-tax rate of return. Notice that as inflation rises, your after-tax rate of return plummets.

(see image)

Nominal Real After-Tax Nominal Inflation After-Tax Return Interest Rate i (ETT = TT) Return 2/3 X i (2/3 X i) - T 15% 12% 10% -2% 6% 3% 12% 9% 90% 87% 900% 897%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts