Question: Let's use Stephanie as our test case. Let's say that Stephanie was trying to compare the impact of sales tax living in San Francisco, CA

Let's use Stephanie as our test case.

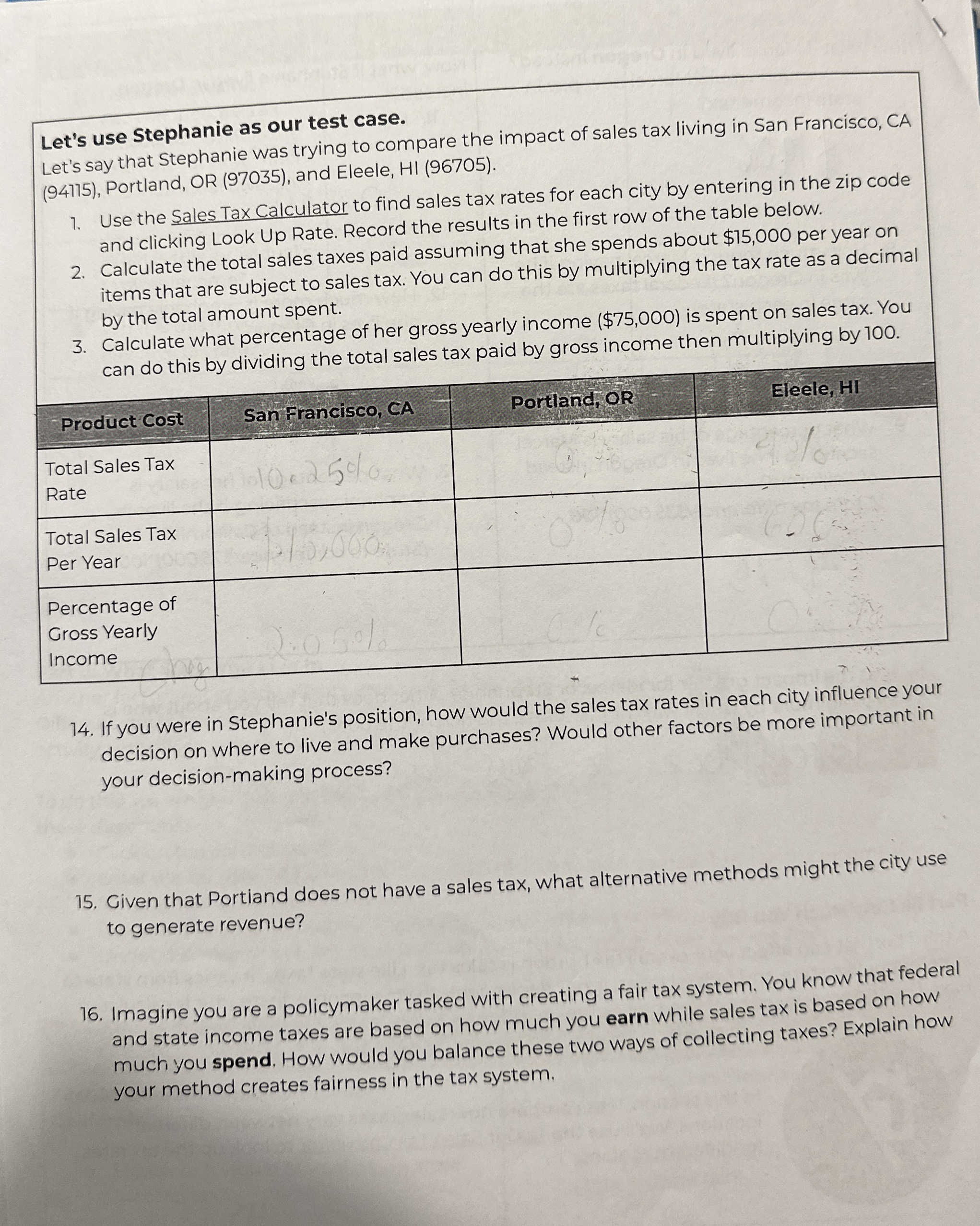

Let's say that Stephanie was trying to compare the impact of sales tax living in San Francisco, CA Portland, OR and Eleele, HI

Use the Sales Tax Calculator to find sales tax rates for each city by entering in the zip code and clicking Look Up Rate. Record the results in the first row of the table below.

Calculate the total sales taxes paid assuming that she spends about $ per year on items that are subject to sales tax. You can do this by multiplying the tax rate as a decimal by the total amount spent.

Calculate what percentage of her gross yearly income $ is spent on sales tax. You can do this by dividing the total sales tax paid by gross income then multiplying by

tableProduct Cost,San Francisco, CAPortland, OREleele, HItableTotal Sales TaxRateP

If you were in Stephanie's position, how would the sales tax rates in each city influence your decision on where to live and make purchases? Would other factors be more important in your decisionmaking process?

Given that Portiand does not have a sales tax, what alternative methods might the city use to generate revenue?

Imagine you are a policymaker tasked with creating a fair tax system, You know that federal and state income taxes are based on how much you earn while sales tax is based on how much you spend. How would you balance these two ways of collecting taxes? Explain how your method creates fairness in the tax system.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock