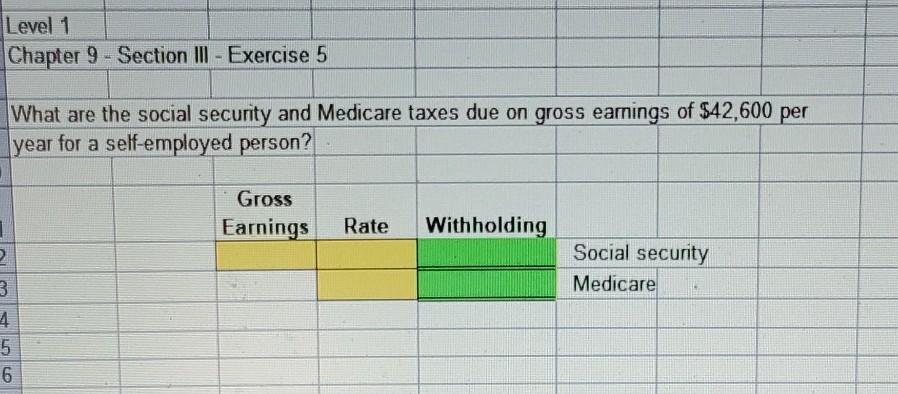

Question: Level 1 Chapter 9 - Section II - Exercise 5 What are the social security and Medicare taxes due on gross earnings of $42,600 per

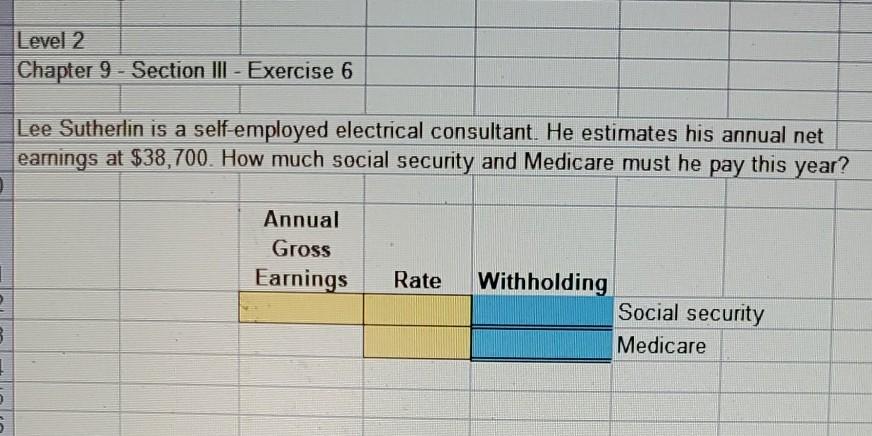

Level 1 Chapter 9 - Section II - Exercise 5 What are the social security and Medicare taxes due on gross earnings of $42,600 per year for a self-employed person? Gross Earnings Rate Withholding 1 2 Social security Medicare 3 1 5 6 on m Level 2 Chapter 9 - Section III - Exercise 6 Lee Sutherlin is a self-employed electrical consultant. He estimates his annual net earnings at $38,700. How much social security and Medicare must he pay this year? Annual Gross Earnings Rate Withholding Social security Medicare 3 . 5 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts