Question: level? lo capital structure, explain why organisations may not wish to operate at optimal (3.5 Marks) QUESTION 2 CAPITAL BUDGETING (40 Marks) PARTA A bicycle

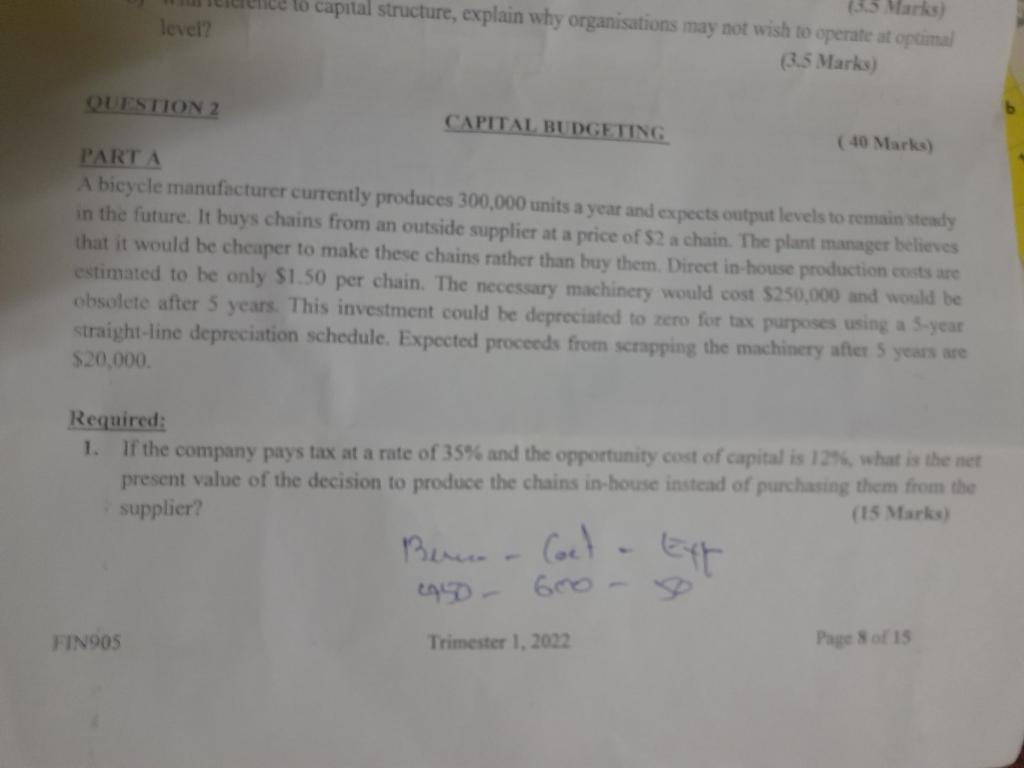

level? lo capital structure, explain why organisations may not wish to operate at optimal (3.5 Marks) QUESTION 2 CAPITAL BUDGETING (40 Marks) PARTA A bicycle manufacturer currently produces 300,000 units a year and expects output levels to remain steady in the future. It buys chains from an outside supplier at a price of $2 a chain. The plant manager believes that it would be cheaper to make these chains rather than buy them. Direct in-house production costs are estimated to be only $1.50 per chain. The necessary machinery would cost $250,000 and would be obsolete after 5 years. This investment could be depreciated to rero for tax purposes using a 5-year straight-line depreciation schedule. Expected proceeds from scrapping the machinery after 5 years are $20,000 Required: 1. If the company pays tax at a rate of 35% and the opportunity cost of capital is 12%, what is the net present value of the decision to produce the chains in-house instead of purchasing them from the supplier? (15 Marks Berna Coet. 1490 - 600 FIN905 Trimester 1, 2022 Page of 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts