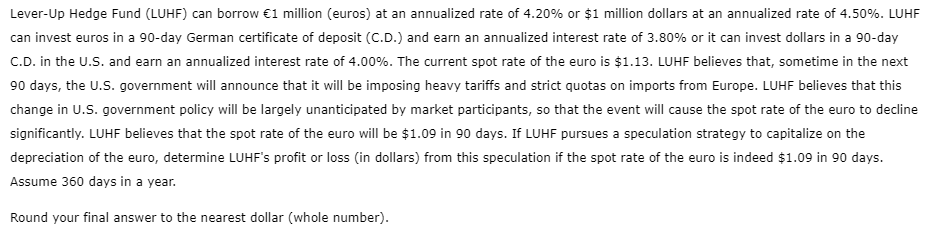

Question: Lever - Up Hedge Fund ( LUHF ) can borrow 1 million ( euros ) at an annualized rate of 4 . 2 0 %

LeverUp Hedge Fund LUHF can borrow million euros at an annualized rate of or $ million dollars at an annualized rate of LUHF

can invest euros in a day German certificate of deposit CD and earn an annualized interest rate of or it can invest dollars in a day

CD in the US and earn an annualized interest rate of The current spot rate of the euro is $ LUHF believes that, sometime in the next

days, the US government will announce that it will be imposing heavy tariffs and strict quotas on imports from Europe. LUHF believes that this

change in US government policy will be largely unanticipated by market participants, so that the event will cause the spot rate of the euro to decline

significantly. LUHF believes that the spot rate of the euro will be $ in days. If LUHF pursues a speculation strategy to capitalize on the

depreciation of the euro, determine LUHF's profit or loss in dollars from this speculation if the spot rate of the euro is indeed $ in days.

Assume days in a year.

Round your final answer to the nearest dollar whole number

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock