Question: Leverage: 12. Explain the following CDS. What are the payments between the two party when Lehman is in business, and when Lehman is out of

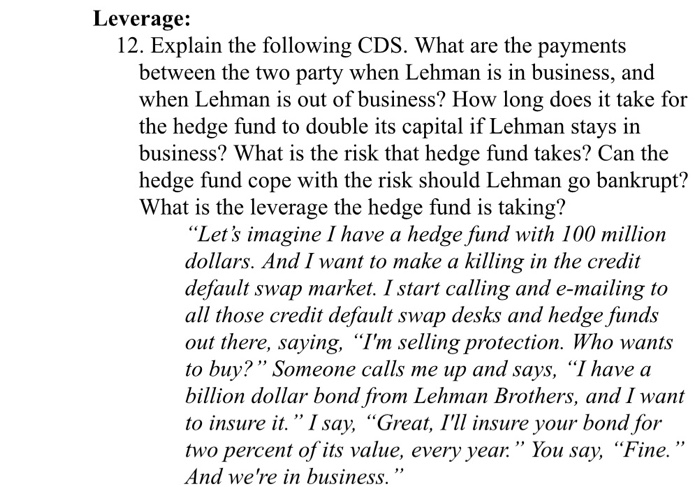

Leverage: 12. Explain the following CDS. What are the payments between the two party when Lehman is in business, and when Lehman is out of business? How long does it take for the hedge fund to double its capital if Lehman stays in business? What is the risk that hedge fund takes? Can the hedge fund cope with the risk should Lehman go bankrupt? What is the leverage the hedge fund is taking? "Let's imagine I have a hedge fund with 100 million dollars. And I want to make a killing in the credit default swap market. I start calling and e-mailing to all those credit default swap desks and hedge funds out there, saying, I'm selling protection. Who wants to buy? Someone calls me up and says, I have a billion dollar bond from Lehman Brothers, and I want to insure it." I say, "Great, I'll insure your bond for two percent of its value, every year. You say, "Fine." And we're in business.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts