Question: Leverage Indifference. Top Corp. is considering a restructuring. Currently, it is all - equity financed with 7 , 0 0 0 , 0 0 0

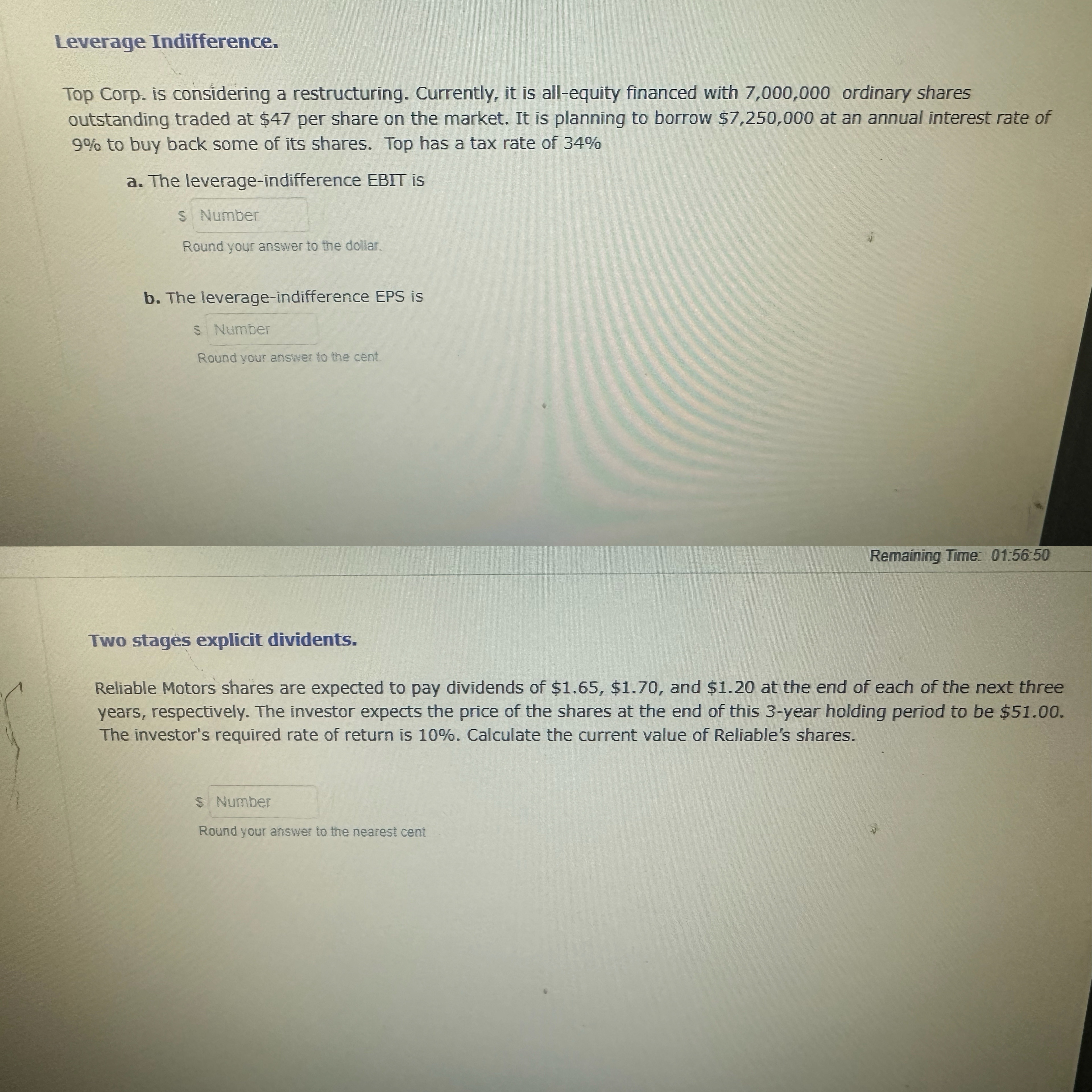

Leverage Indifference.

Top Corp. is considering a restructuring. Currently, it is allequity financed with ordinary shares outstanding traded at $ per share on the market. It is planning to borrow $ at an annual interest rate of to buy back some of its shares. Top has a tax rate of

a The leverageindifference EBIT is

s Number

Round your answer to the dollar.

b The leverageindifference EPS is

s Number

Round your answer to the cent.

Remaining Time: ::

Two stages explicit dividents.

Reliable Motors shares are expected to pay dividends of $$ and $ at the end of each of the next three years, respectively. The investor expects the price of the shares at the end of this year holding period to be $ The investor's required rate of return is Calculate the current value of Reliable's shares.

Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock