Question: Leveraging. Consider an asset with return time series over T periods given by the T- vector r. This asset has mean ret urn u

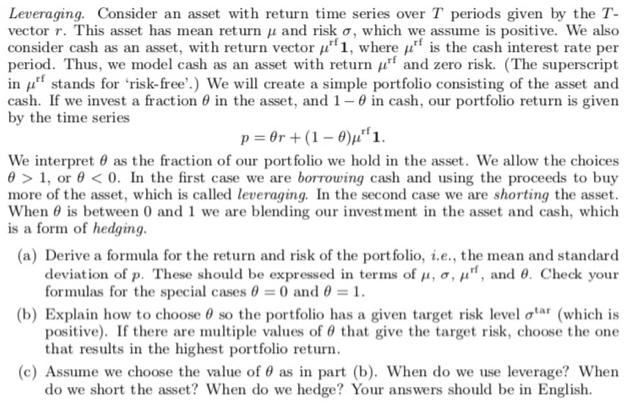

Leveraging. Consider an asset with return time series over T periods given by the T- vector r. This asset has mean ret urn u and risk o, which we assume is positive. We also consider cash as an asset, with return vector 1, where " is the cash interest rate per period. Thus, we model cash as an asset with return f and zero risk. (The superscript in p" stands for 'risk-free'.) We will create a simple portfolio consisting of the asset and cash. If we invest a fraction 0 in the asset, and 1-0 in cash, our portfolio return is given by the time series p = Or + (1 0)"1. We interpret 6 as the fraction of our port folio we hold in the asset. We allow the choices 0 > 1, or 0 < 0. In the first case we are borrowing cash and using the proceeds to buy more of the asset, which is called leveraging. In the second case we are shorting the asset. When 6 is between 0 and 1 we are blending our invest ment in the asset and cash, which is a form of hedging. (a) Derive a formula for the return and risk of the port folio, i.e., the mean and standard deviation of p. These should be expressed in terms of u, o, p", and 0. Check your formulas for the special cases 0 = 0 and 0 1. (b) Explain how to choose 0 so the portfolio has a given target risk level otar (which is positive). If there are multiple values of 6 that give the target risk, choose the one that results in the highest portfolio return. (c) Assume we choose the value of 0 as in part (b). When do we use leverage? When do we short the asset? When do we hedge? Your answers should be in English.

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

To solve the problems related to leveraging with the given investible asset and cash follow these st... View full answer

Get step-by-step solutions from verified subject matter experts