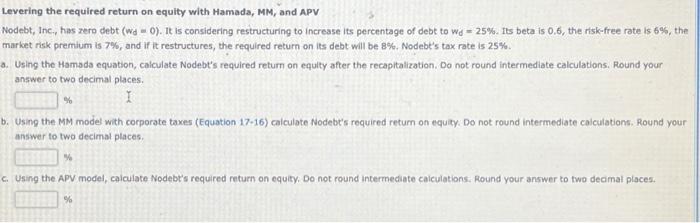

Question: Levering the required return on equity with Hamada, MM, and APV Nodebt, Inc., has zero debt (ws - 0). It is considering restructuring to Increase

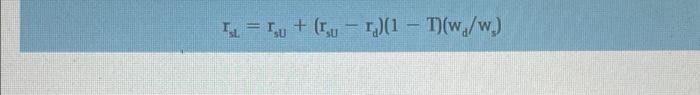

Levering the required return on equity with Hamada, MM, and APV Nodebt, Inc., has zero debt (ws - 0). It is considering restructuring to Increase its percentage of debt to wo = 25%. Its beta is 0.6, the risk-free rate is 6%, the market risk premium is 7%, and if it restructures, the required return on its debt will be 8%. Nodebt's tax rate is 25% a. Using the Hamada equation, calculate Nodebt's required return on equity after the recapitalization. Do not round intermediate calculations. Round your answer to two decimal places 1 b. Using the MM model with corporate taxes (Equation 17-16) calculate Nodebt's required return on equity Do not round intermediate calculations, Round your answer to two decimal places % c. Using the APV model, calculate Nodebt's required return on equity. Do not round Intermediate calculations. Round your answer to two decimal places. % I= Tu + (Txu - 1)(1 - 1)(w/w)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts