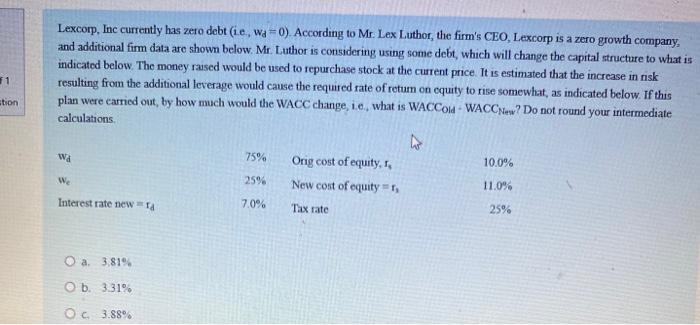

Question: Lexcorp, Inc currently has zero debt (ie, wd =0 ). According to Mr. Lex Luthor, the firm's CEO, Lexcorp is a zero growth company, and

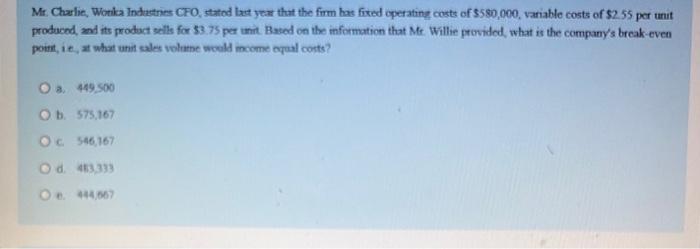

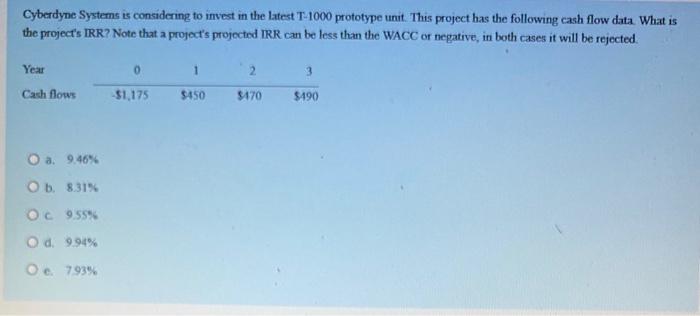

Lexcorp, Inc currently has zero debt (ie, wd =0 ). According to Mr. Lex Luthor, the firm's CEO, Lexcorp is a zero growth company, and additional firm data are shown below. Mr. Luthor is considering using some debt, which will change the capital structure to what is indicated below. The money rased would be used to repurchase stock at the current price. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of retum on cquity to rise somewhat, as indicated below. If this plan were carried out, by how much would the WACC change, 1.6, what is WACCOld - WACCNaw? Do not round your intermediate calculations, wd we Interest rate new =rd a. 3.81% b. 3.31% c. 3.88% Mr. Charlie, Woria Industnes CFO, stated last year thut the firm has fixed operating costs of $580,000, variable costs of $2.55 per unit prodused, and its prodact sells for 53.75 per unit Based on the information that Mer. Willie provided, what is the company's break-even point, it, at what unit cales volume would moome cyual corts? 3. 449,500 b. 575,167 c. 546,167 d. 463,333 c. 444,667 Cyberdyne Systems is considering to invest in the latest T-1000 prototype unit. This project has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC or negative, in both cases it will be rejected. a. 9.46% b. 8.31% c 9.55% d. 9.94% c. 793%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts