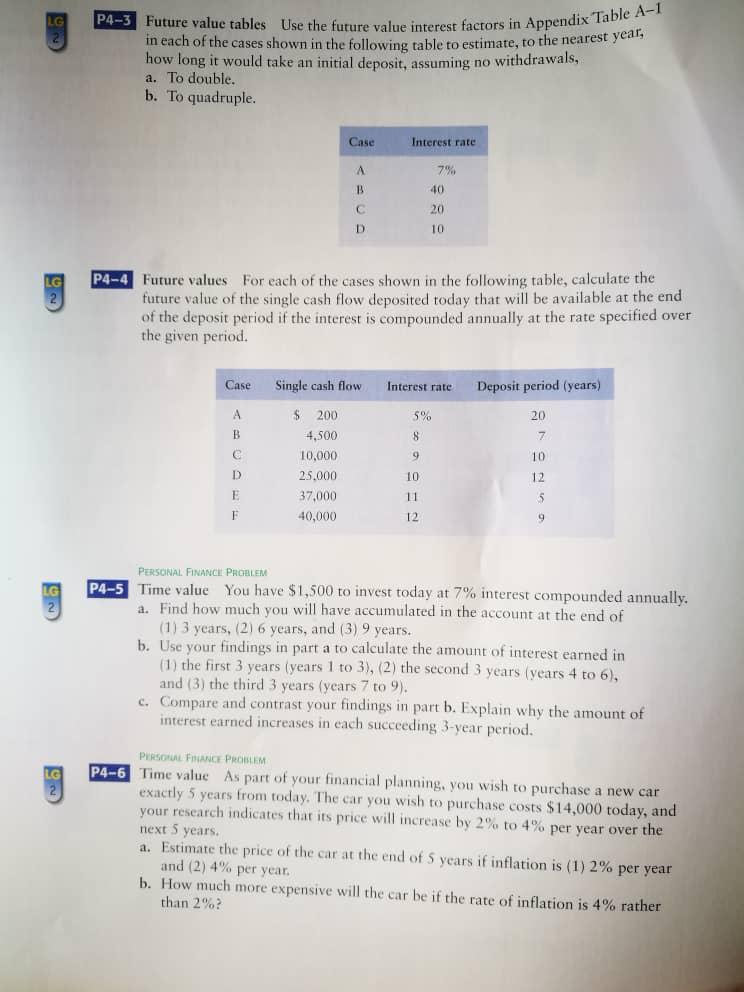

Question: LG P4-3 Future value tables Use the future value interest factors in Appendix Table A-1 in each of the cases shown in the following table

LG P4-3 Future value tables Use the future value interest factors in Appendix Table A-1 in each of the cases shown in the following table to estimate, to the nearest year, how long it would take an initial deposit, assuming no withdrawals, a. To double. b. To quadruple. Case Interest rate A B 7% 40 20 10 D LG P4-4 Future values For each of the cases shown in the following table, calculate the future value of the single cash flow deposited today that will be available at the end of the deposit period if the interest is compounded annually at the rate specified over the given period. Case Single cash flow Interest rate Deposit period (years) A B $ 200 4,500 10,000 25,000 37,000 40,000 5% 8 9 10 11 20 7 10 D 12 E 5 9 1 12 PERSONAL FINANCHI PROBLEM P4-5 Time value You have $1,500 to invest today at 7% interest compounded annually. a. Find how much you will have accumulated in the account at the end of (1) 3 years, (2) 6 years, and (3) 9 years. b. Use your findings in part a to calculate the amount of interest earned in (1) the first 3 years (years 1 to 3), (2) the second 3 years (years 4 to 6), and (3) the third 3 years (years 7 to 9). c. Compare and contrast your findings in part b. Explain why the amount of interest earned increases in each succeeding 3-year period. LG PERSONAL PLANCE PROBLEM P4-6 Time value As part of your financial planning, you wish to purchase a new car exactly 5 years from today. The car you wish to purchase costs $14,000 today, and your research indicates that its price will increase 2% to 4% per year over the next 5 years. a. Estimate the price of the car at the end of 5 years if inflation is (1) 2% per year and (2) 4% per year. b. How much more expensive will the car be if the rate of inflation is 4% rather than 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts