Question: LG Warning! Due to inactivity, x D2L Chapter 14 Homework - 11 x M Question 9 - Chapter 14 H( X Business Use of the

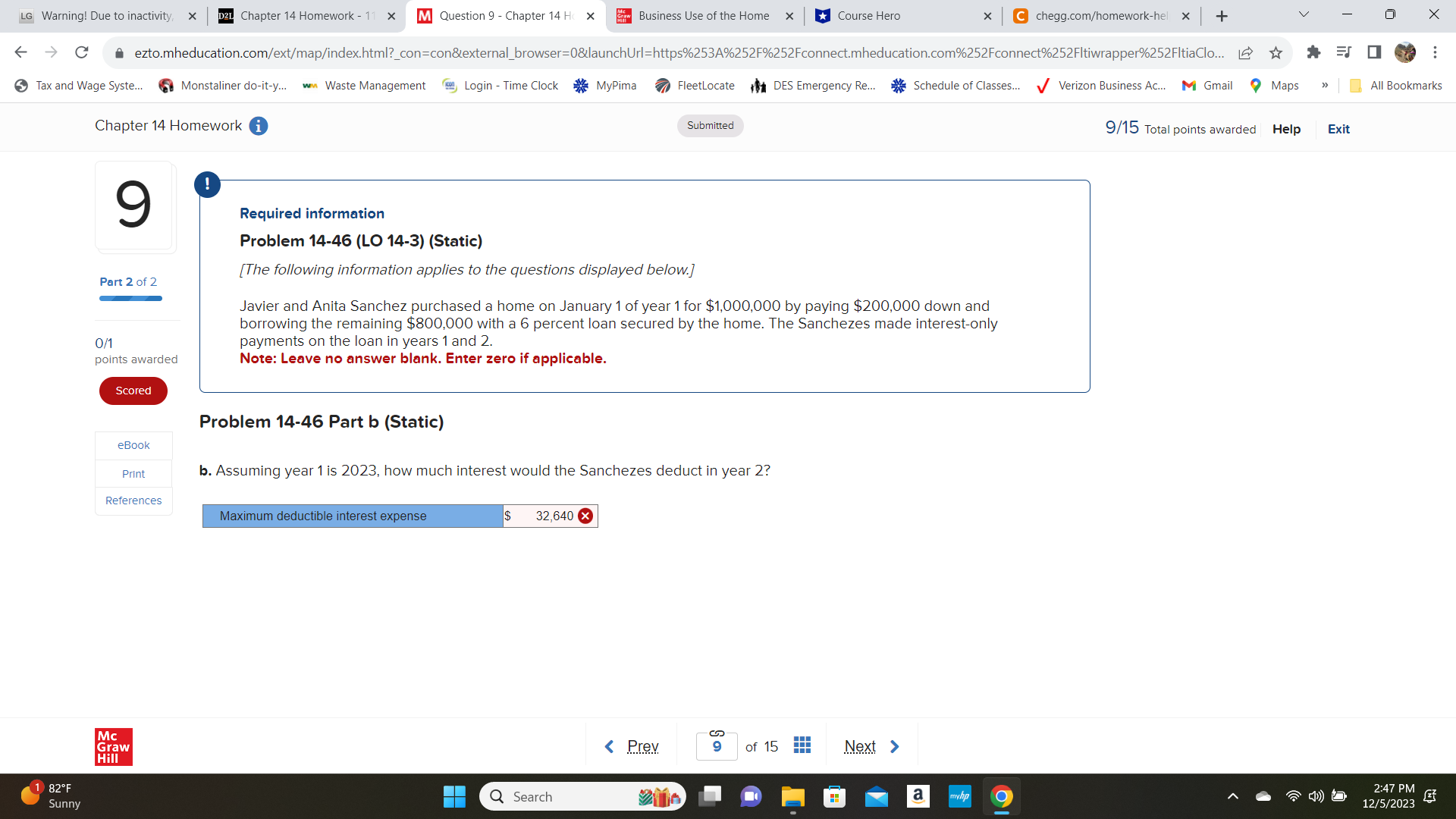

LG Warning! Due to inactivity, x D2L Chapter 14 Homework - 11 x M Question 9 - Chapter 14 H( X Business Use of the Home x *Course Hero x C chegg.com/homework-hel x + V X C ^ ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fconnect.mheducation.com%252Fconnect%252Fltiwrapper%252FltiaClo... Tax and Wage System. Monstaliner do-it-y.. ww Waste Management Login - Time Clock MyPima FleetLocate DES Emergency Re.. Schedule of Classes... Verizon Business Ac... M Gmail Maps All Bookmarks Chapter 14 Homework i Submitted 9/15 Total points awarded Help Exit 9 Required information Problem 14-46 (LO 14-3) (Static) [The following information applies to the questions displayed below.] Part 2 of 2 Javier and Anita Sanchez purchased a home on January 1 of year 1 for $1,000,000 by paying $200,000 down and borrowing the remaining $800,000 with a 6 percent loan secured by the home. The Sanchezes made interest-only 0/1 payments on the loan in years 1 and 2. points awarded Note: Leave no answer blank. Enter zero if applicable. Scored Problem 14-46 Part b (Static) eBook Print b. Assuming year 1 is 2023, how much interest would the Sanchezes deduct in year 2? References Maximum deductible interest expense $ 32,640 X Mc Graw Hill 1 82 F Q Search a hyhp 2:47 PM sunny 12/5/2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts