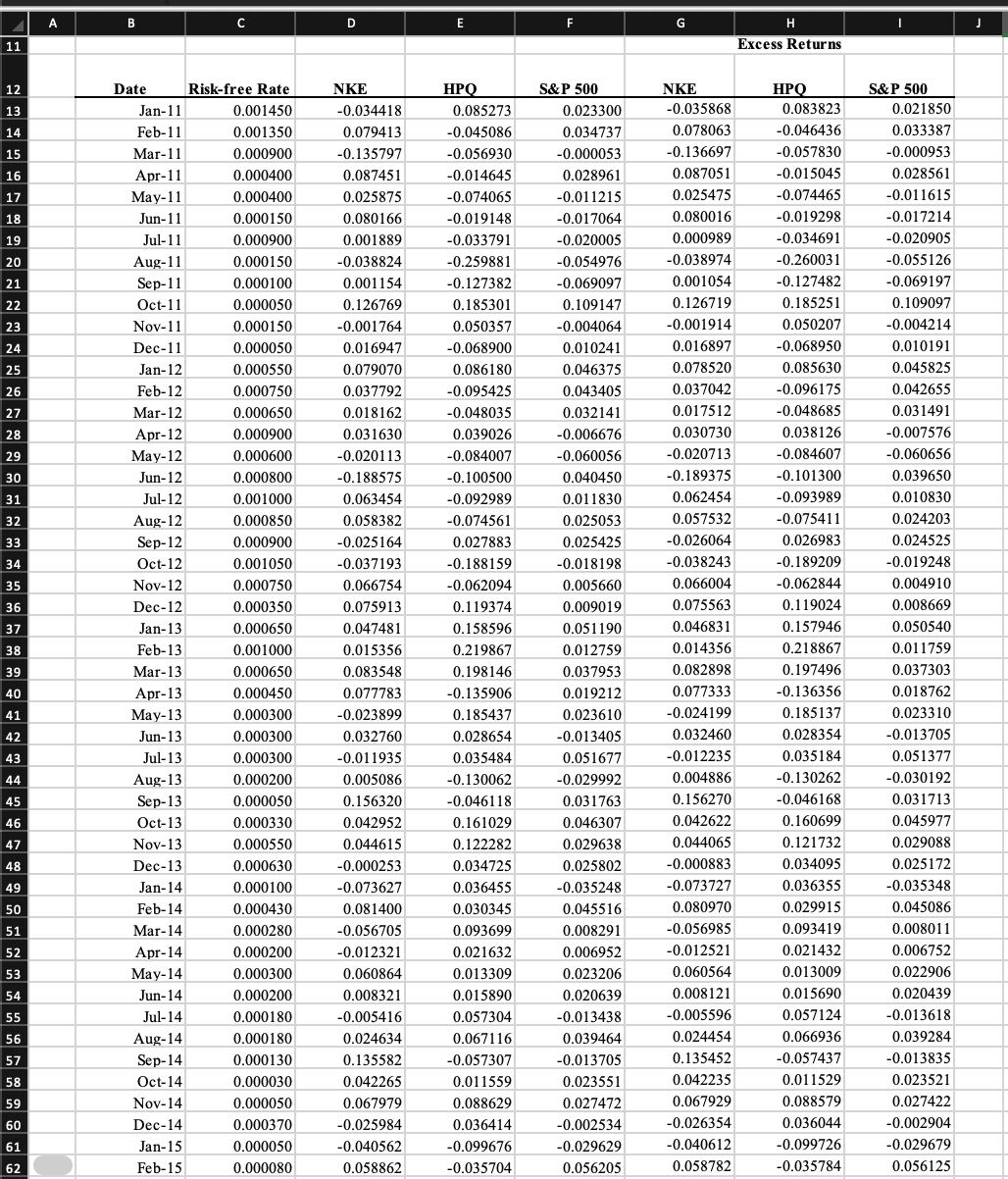

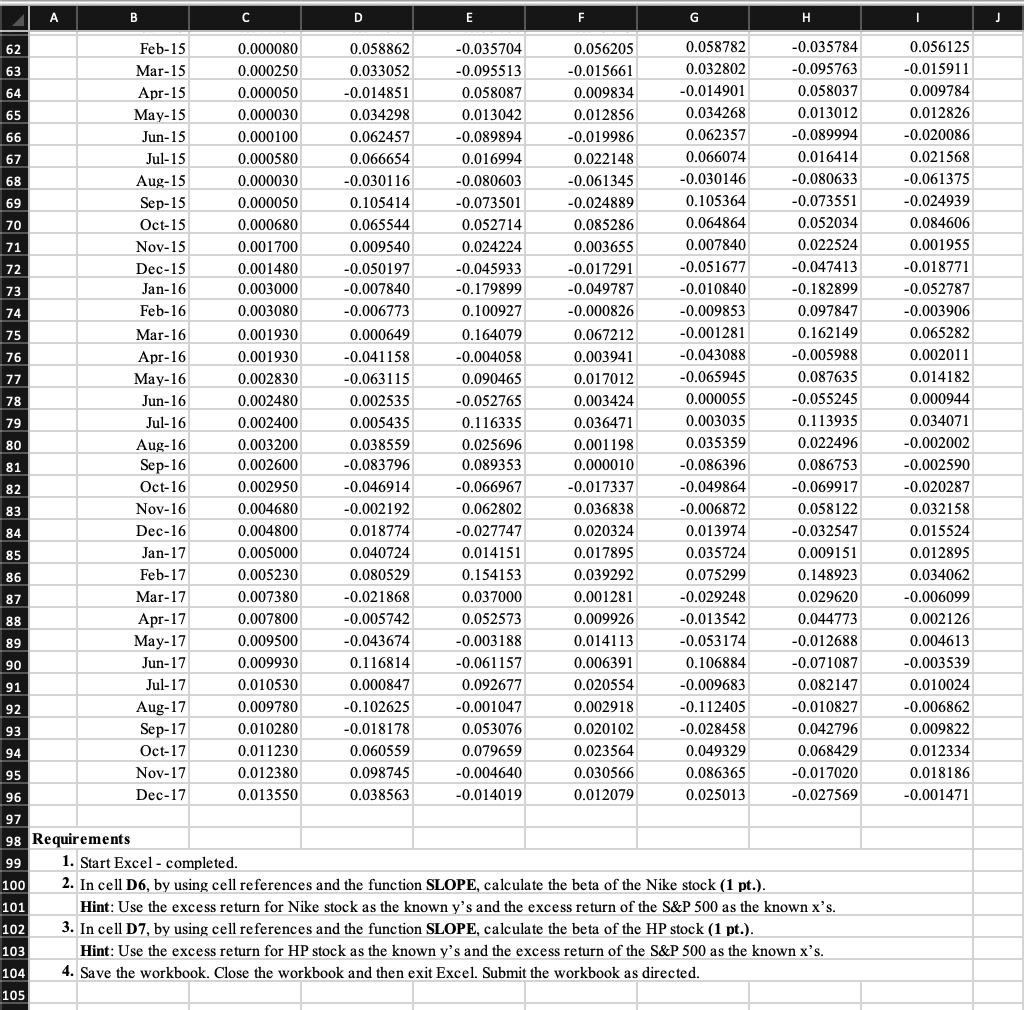

Question: LI I T B Problem 12-11 Use the data far below to estimate the beta of Nike (NKE) and HP (HPQ) stock based on their

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts