Question: = LIA _ Part _ 2 _ Question _ with _ Unadjusted _ TB - Protected View Saved V Search Design Layout References Mailings Review

LIAPartQuestionwithUnadjustedTB Protected View Saved V

Search

Design Layout References Mailings Review View Zotero Help Acrobat

files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing

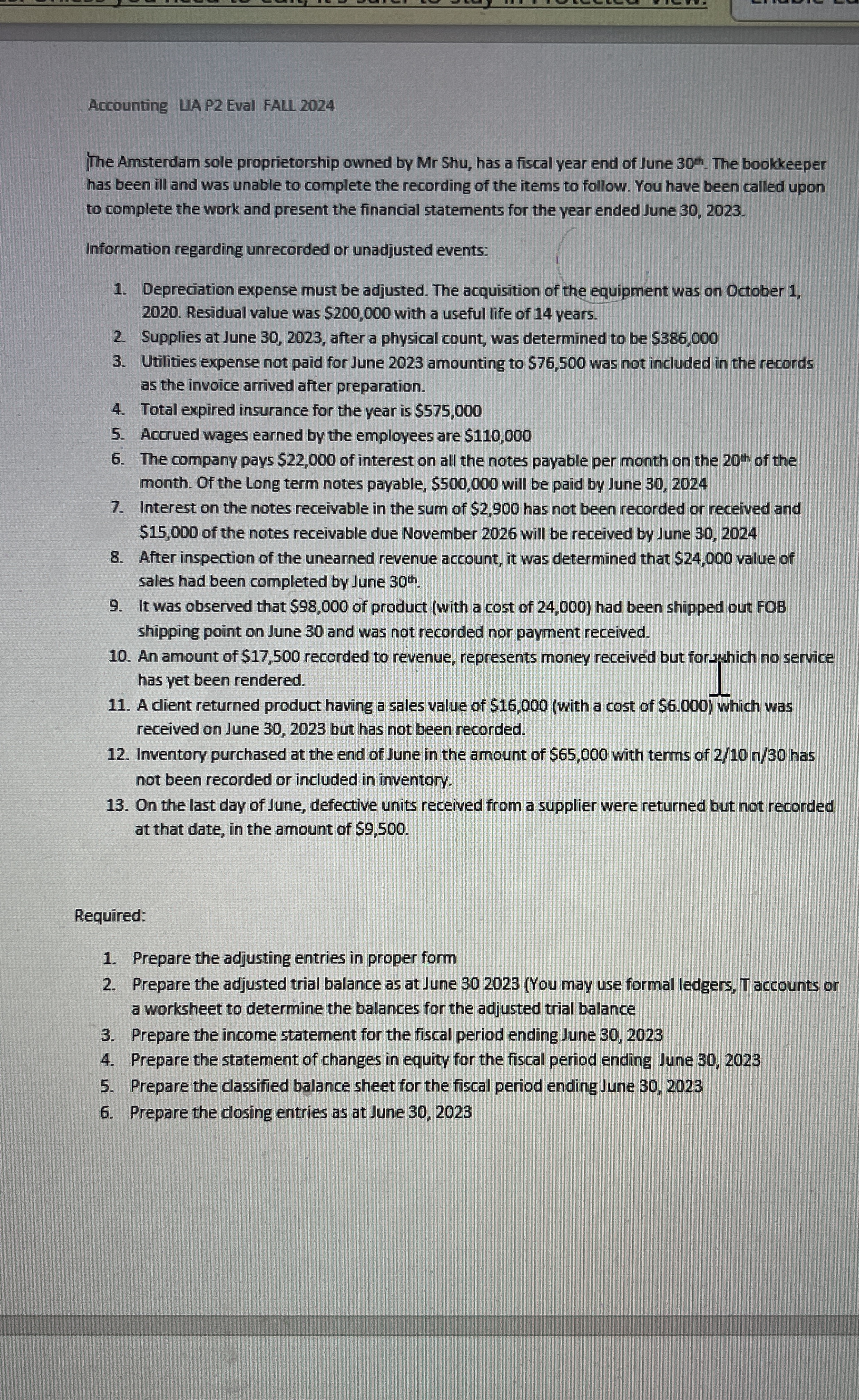

The Amsterdam sole proprietorship owned by Mr Shu, has a fiscal year end of June The bookkeeper has been ill and was unable to complete the recording of the items to follow. You have been called upon to complete the work and present the financial statements for the year ended June

Information regarding unrecorded or unadjusted events:

Depreciation expense must be adjusted. The acquisition of the equipment was on October Residual value was $ with a useful life of years.

Supplies at June after a physical count, was determined to be $

Utilities expense not paid for June amounting to $ was not included in the records as the invoice arrived after preparation. I

Total expired insurance for the year is $

Accrued wages earned by the employees are $

The company pays $ of interest on all the notes payable per month on the of the month. Of the Long term notes payable, $ will be paid by June

Interest on the notes receivable in the sum of $ has not been recorded or received and $ of the notes receivable due November will be received by June

After inspection of the unearned revenue account, it was determined that $ value of sales had been completed by June

It was observed that $ of product with a cost of had been shipped out FOB shipping point on June and was not recorded nor payment received.

An amount of $ recorded to revenue, represents money received but for which no service has yet been rendered.

A client returned product having a sales value of $with a cost of $ which was received on June but has not been recorded.

Inventory purchased at the end of June in the amount of $ with terms of has not been recorded or included in inventory.

On the last day of June, defective units received from a supplier were returned but not recorded at that date, in the amount of $

B Focus

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock