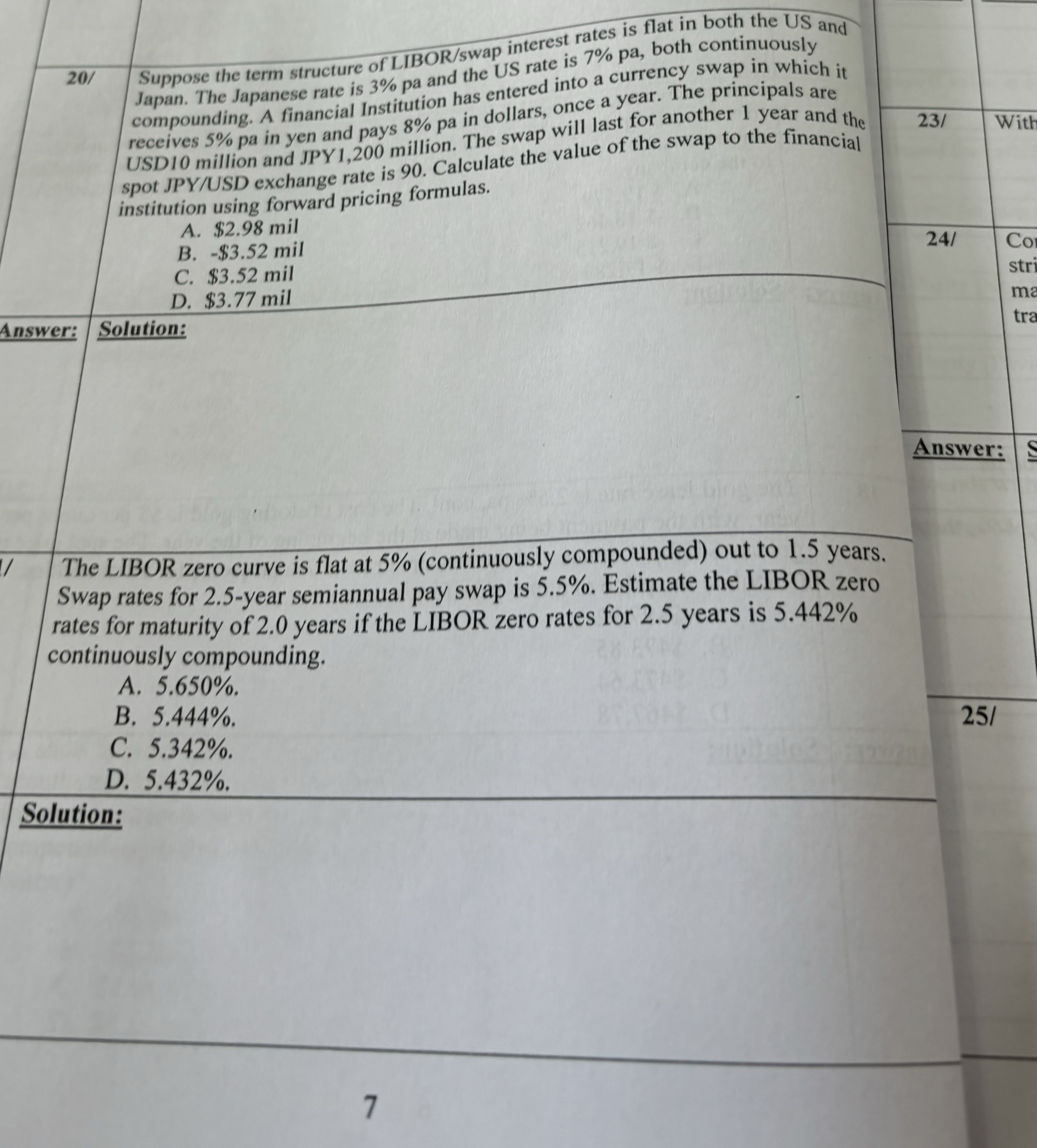

Question: ( LIBO R 2 ? swap interest rates is flat in both the US and 2 0 ? compounding. A financial Institution has entered into

LIBO swap interest rates is flat in both the US and

compounding. A financial Institution has entered into a currency swap in which it receives pa in yen and pays pa in dollars, once a year. Torer another year and USD million and JPY million. The swap will last for swap to the finan the spot JPYUSD exchange rate is Calculate the value of institution using forward pricing formulas.

A $mil

B$mil

C $mil

D $mil

Answer:

Solution:

Answer:

The LIBOR zero curve is flat at continuously compounded out to years. Swap rates for year semiannual pay swap is Estimate the LIBOR zero rates for maturity of years if the LIBOR zero rates for years is continuously compounding.

A

B

C

D

Solution:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock