Question: Life Science Incorporated (LSI) is a firm with no debt and its 20 million shares are currently trading for $16 per share. Based on

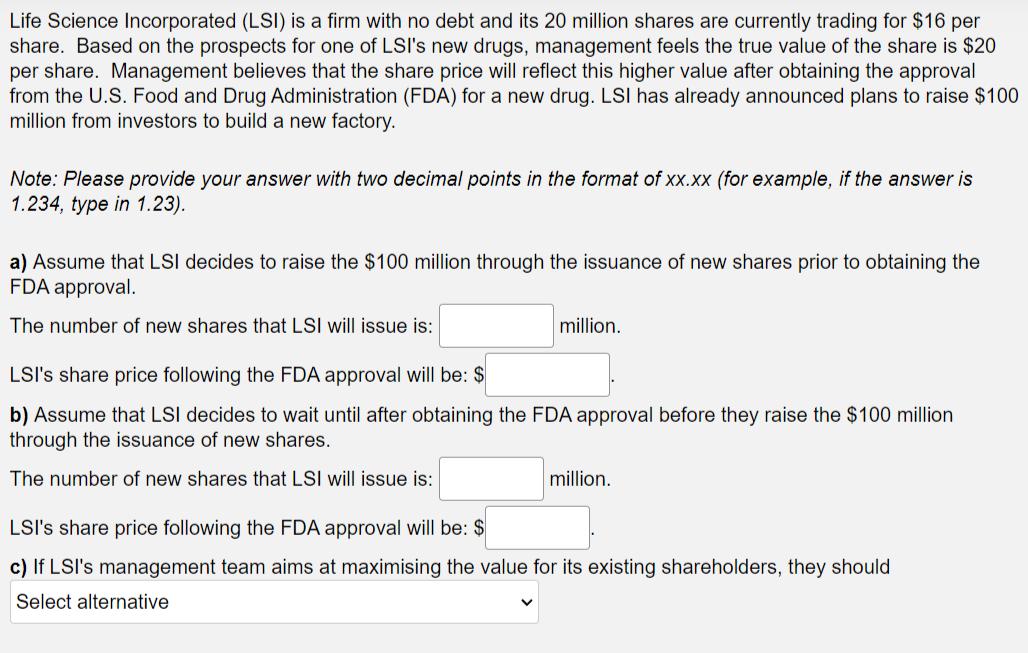

Life Science Incorporated (LSI) is a firm with no debt and its 20 million shares are currently trading for $16 per share. Based on the prospects for one of LSI's new drugs, management feels the true value of the share is $20 per share. Management believes that the share price will reflect this higher value after obtaining the approval from the U.S. Food and Drug Administration (FDA) for a new drug. LSI has already announced plans to raise $100 million from investors to build a new factory. Note: Please provide your answer with two decimal points in the format of xx.xx (for example, if the answer is 1.234, type in 1.23). a) Assume that LSI decides to raise the $100 million through the issuance of new shares prior to obtaining the FDA approval. The number of new shares that LSI will issue is: million. LSI's share price following the FDA approval will be: $ b) Assume that LSI decides to wait until after obtaining the FDA approval before they raise the $100 million through the issuance of new shares. The number of new shares that LSI will issue is: million. LSI's share price following the FDA approval will be: $ c) If LSI's management team aims at maximising the value for its existing shareholders, they should Select alternative

Step by Step Solution

There are 3 Steps involved in it

LSI Capital Raise and Share Price Analysis Assumptions Current share price16 per share Number of out... View full answer

Get step-by-step solutions from verified subject matter experts