Question: Lifecycle Costing (LCC) & Facility Engineering & Management - ENGR155-01 Victor and his team work in the facilities engineering and construction department for a local

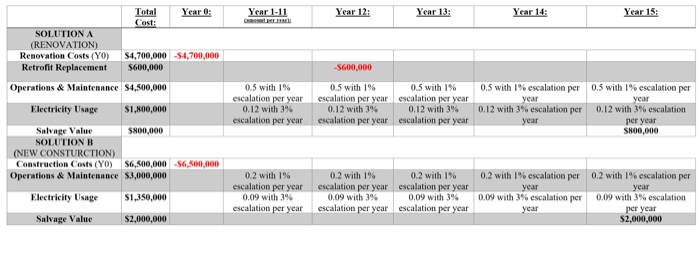

Lifecycle Costing (LCC) & Facility Engineering & Management - ENGR155-01 Victor and his team work in the facilities engineering and construction department for a local university. They have been provided (2) options to consider regarding the upkeep, functionality, and overall performance of an older structure on campus nearing the end of its lifecycle. Solution (A) - Major renovation to the existing structure. Solution (B) - Demolition & new construction of the aging structure completely To assist in evaluating both options, a lifecycle costing report (LCC) has been prepared below. Given the following information: 1.) Solve using factor notation & compound interest tables. 2.) Solve by creating a cash flow for the 15-year study period, then use net present value (NPV) **Must Use Excel 3.) Utilizing the NPV analysis, which alternative (A or B) is the better solution that Victor and his team should consider? Why? **Hint Use Market Discount rate of 8%. Total Year : Year 1.11 Year 13: Year 14: Year 15: SOLUTION A (RENOVATION) Renovation Costs (YO) Retrofit Replacement $4,700,000 S4,700,000 S600,000 -5600,000 Operations & Maintenance S4,500,000 0.5 with 1% escalation per year 0.12 with 3% escalation per year 0.5 with 1% escalation per year 0.12 with 3% escalation per year Electricity Usage 0.5 with 1% escalation per year 0.12 with 3% escalation per year $1,800,000 0.5 with 1% escalation per year 0.12 with 3% escalation per year 0.5 with 1% escalation per year 0.12 with 3% escalation per year S800,000 Salvage Value $800,000 SOLUTION (NEW CONSTURCTION) Construction Costs (YO) S6,800,000 Operations & Maintenance 53,000,000 $6,500,000 0.2 with 1% escalation per year Electricity Usage 0.2 with 1% escalation per year 0.09 with 3% escalation per year 0.2 with 1% escalation per year 0.09 with 3% escalation per $1,350,000 0.2 with 1% escalation per year 0.09 with 3% escalation per year 0.2 with 1% escalation per year 0.09 with 3% escalation per year year 0.09 with 3% escalation per year $2,000,000 Salvage Value $2,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts