Question: Light Sweet Petroleum, Inc., is trying to evaluate a generation project with the following cash flows. If the company requires a return of 12

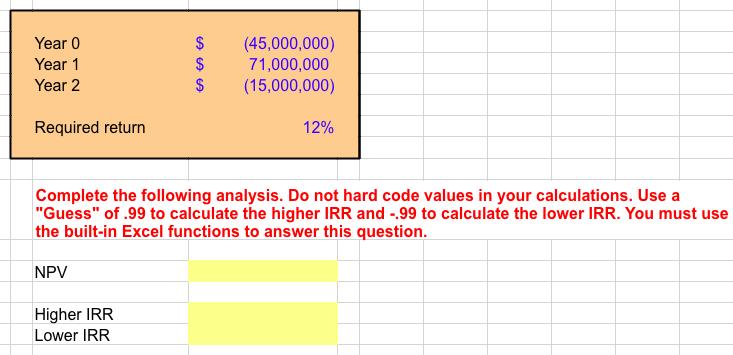

Light Sweet Petroleum, Inc., is trying to evaluate a generation project with the following cash flows. If the company requires a return of 12 percent on its investments, what is the project's NPV? What are the IRRS for the project? Year 0 Year 1 Year 2 Required return $ SASS NPV $ $ (45,000,000) 71,000,000 (15,000,000) 12% Complete the following analysis. Do not hard code values in your calculations. Use a "Guess" of .99 to calculate the higher IRR and -.99 to calculate the lower IRR. You must use the built-in Excel functions to answer this question. Year 0 Year 1 Year 2 Required return NPV $ (45,000,000) $ 71,000,000 (15,000,000) Higher IRR Lower IRR SSS $ Complete the following analysis. Do not hard code values in your calculations. Use a "Guess" of .99 to calculate the higher IRR and -.99 to calculate the lower IRR. You must use the built-in Excel functions to answer this question. 12%

Step by Step Solution

There are 3 Steps involved in it

1 2 3 4 5 6 7 LO CO 8 9 10 11 12 ... View full answer

Get step-by-step solutions from verified subject matter experts