Question: LIII Launch Question 3 - CH 7 Problems : Co Google roblems i Saved Help Save & Exit 1 Required information [ The following information

LIII Launch

Question CH Problems

: Co

Google

roblems

i

Saved

Help

Save & Exit

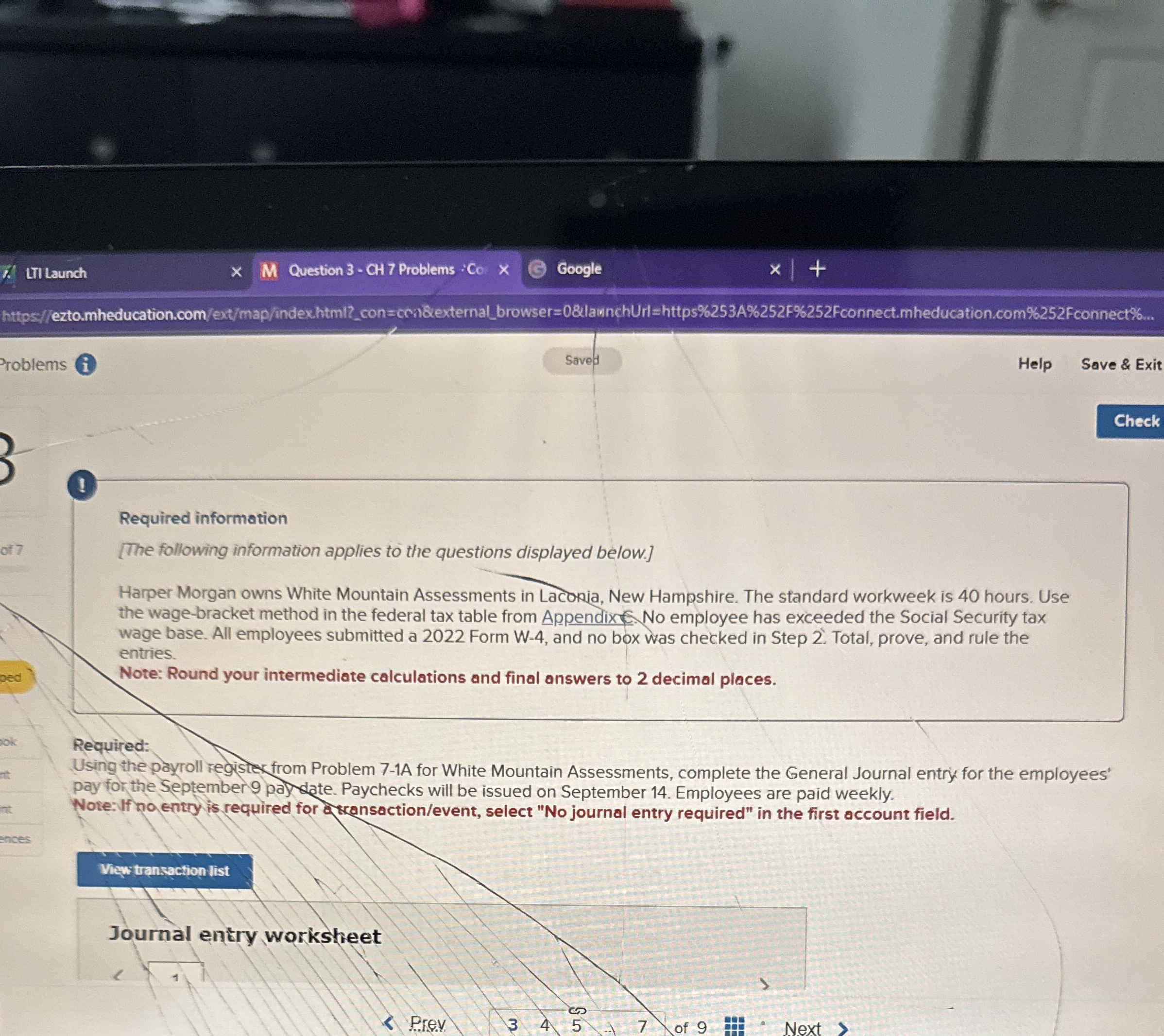

Required information

The following information applies to the questions displayed below.

Harper Morgan owns White Mountain Assessments in Lacokia, New Hampshire. The standard workweek is hours. Use the wagebracket method in the federal tax table from Appendixf. No employee has exceeded the Social Security tax wage base. All employees submitted a Form W and no box was checked in Step Total, prove, and rule the entries.

Note: Round your intermediate calculations and final answers to decimal places.

Required:

Using the payroll regsste from Problem A for White Mountain Assessments, complete the General Journal entry for the employees' pay for the September par date. Paychecks will be issued on September Employees are paid weekly.

Nore: If na entry is required for atransactionevent select No journal entry required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock