Question: Like the format in Figure 8.3 for preparing a Nine-Cell Industry Attractiveness-Competitiveness Strength Matrix , assume the data in the first three columns of the

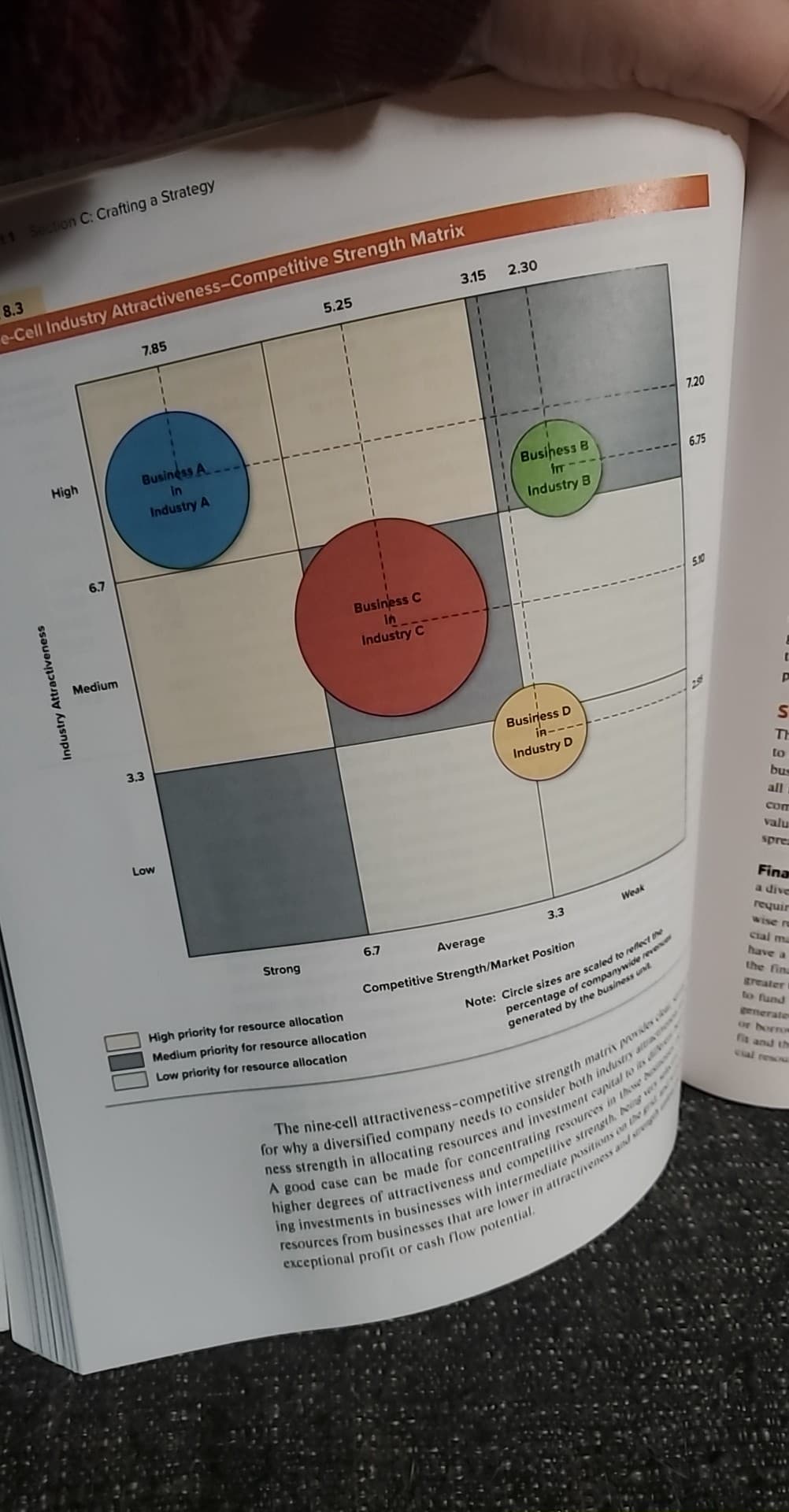

Like the format in Figure 8.3 for preparing a Nine-Cell Industry Attractiveness-Competitiveness Strength Matrix, assume the data in the first three columns of the table below was prepared for the three Disney industry segments in the table. Based on this information complete the fourth column. You should study Figure 8.3 to assist you in completing this table

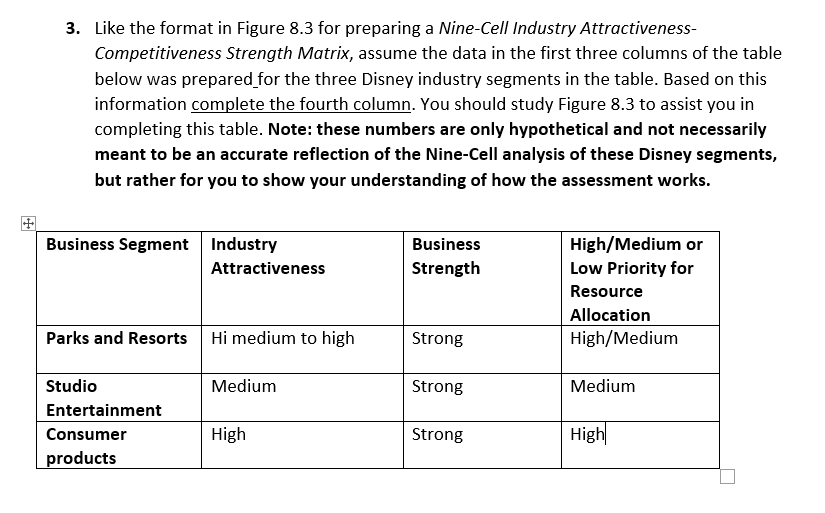

3. Like the format in Figure 8.3 for preparing a Nine-Cell Industry Attractiveness- Competitiveness Strength Matrix, assume the data in the first three columns of the table below was prepared for the three Disney industry segments in the table. Based on this information complete the fourth column. You should study Figure 8.3 to assist you in completing this table. Note: these numbers are only hypothetical and not necessarily meant to be an accurate reflection of the Nine-Cell analysis of these Disney segments, but rather for you to show your understanding of how the assessment works. Business Segment Industry Attractiveness Business Strength High/Medium or Low Priority for Resource Allocation High/Medium Parks and Resorts Hi medium to high Strong Medium Strong Medium Studio Entertainment Consumer products High Strong High on C. Crafting a Strategy 2.30 3.15 5.25 8.3 e-Cell Industry Attractiveness-Competitive Strength Matrix 7.85 7.20 6.75 Business B frr - Industry B Business A in Industry A High 50 6.7 Business C in Industry C t P Industry Attractiveness Medium S Business D iA--- Industry D TI to bus all 3.3 con valu spre Low Fina Week a dive requir 3.3 6.7 Average Strong cial m. have a the fin Seater to fund enerate Competitive Strength/Market Position Note: Circle sizes are scaled to relle percentage of company wil ne generated by the business fit and the High priority for resource allocation Medium priority for resource allocation Low priority for resource allocation The nine-cell attractiveness-competitive strength matrimony ness strength in allocating resources and investment carvialto for why a diversified company needs to consider both industry A good case can be made for concentrating resources in AA higher degrees of attractiveness and competithe street. A ing investments in businesses with intermediate positions resources from businesses that are lower in altracthenes exceptional profit or cash flow potential. 3. Like the format in Figure 8.3 for preparing a Nine-Cell Industry Attractiveness- Competitiveness Strength Matrix, assume the data in the first three columns of the table below was prepared for the three Disney industry segments in the table. Based on this information complete the fourth column. You should study Figure 8.3 to assist you in completing this table. Note: these numbers are only hypothetical and not necessarily meant to be an accurate reflection of the Nine-Cell analysis of these Disney segments, but rather for you to show your understanding of how the assessment works. Business Segment Industry Attractiveness Business Strength High/Medium or Low Priority for Resource Allocation High/Medium Parks and Resorts Hi medium to high Strong Medium Strong Medium Studio Entertainment Consumer products High Strong High on C. Crafting a Strategy 2.30 3.15 5.25 8.3 e-Cell Industry Attractiveness-Competitive Strength Matrix 7.85 7.20 6.75 Business B frr - Industry B Business A in Industry A High 50 6.7 Business C in Industry C t P Industry Attractiveness Medium S Business D iA--- Industry D TI to bus all 3.3 con valu spre Low Fina Week a dive requir 3.3 6.7 Average Strong cial m. have a the fin Seater to fund enerate Competitive Strength/Market Position Note: Circle sizes are scaled to relle percentage of company wil ne generated by the business fit and the High priority for resource allocation Medium priority for resource allocation Low priority for resource allocation The nine-cell attractiveness-competitive strength matrimony ness strength in allocating resources and investment carvialto for why a diversified company needs to consider both industry A good case can be made for concentrating resources in AA higher degrees of attractiveness and competithe street. A ing investments in businesses with intermediate positions resources from businesses that are lower in altracthenes exceptional profit or cash flow potential

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts