Question: = lil 1. How much cash will be generated from internal operations by the end of 2013? 2. Will the owners have to borrow

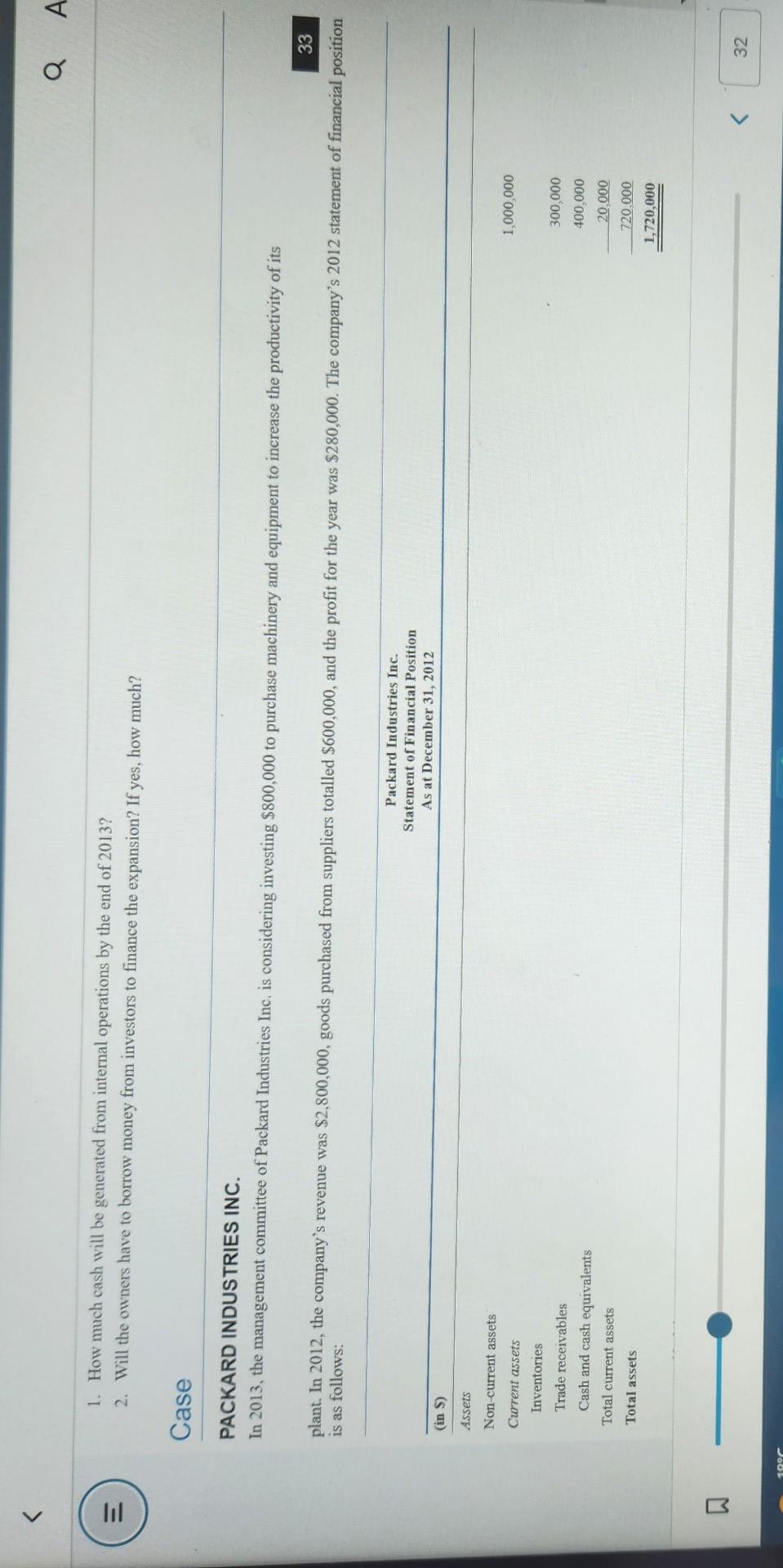

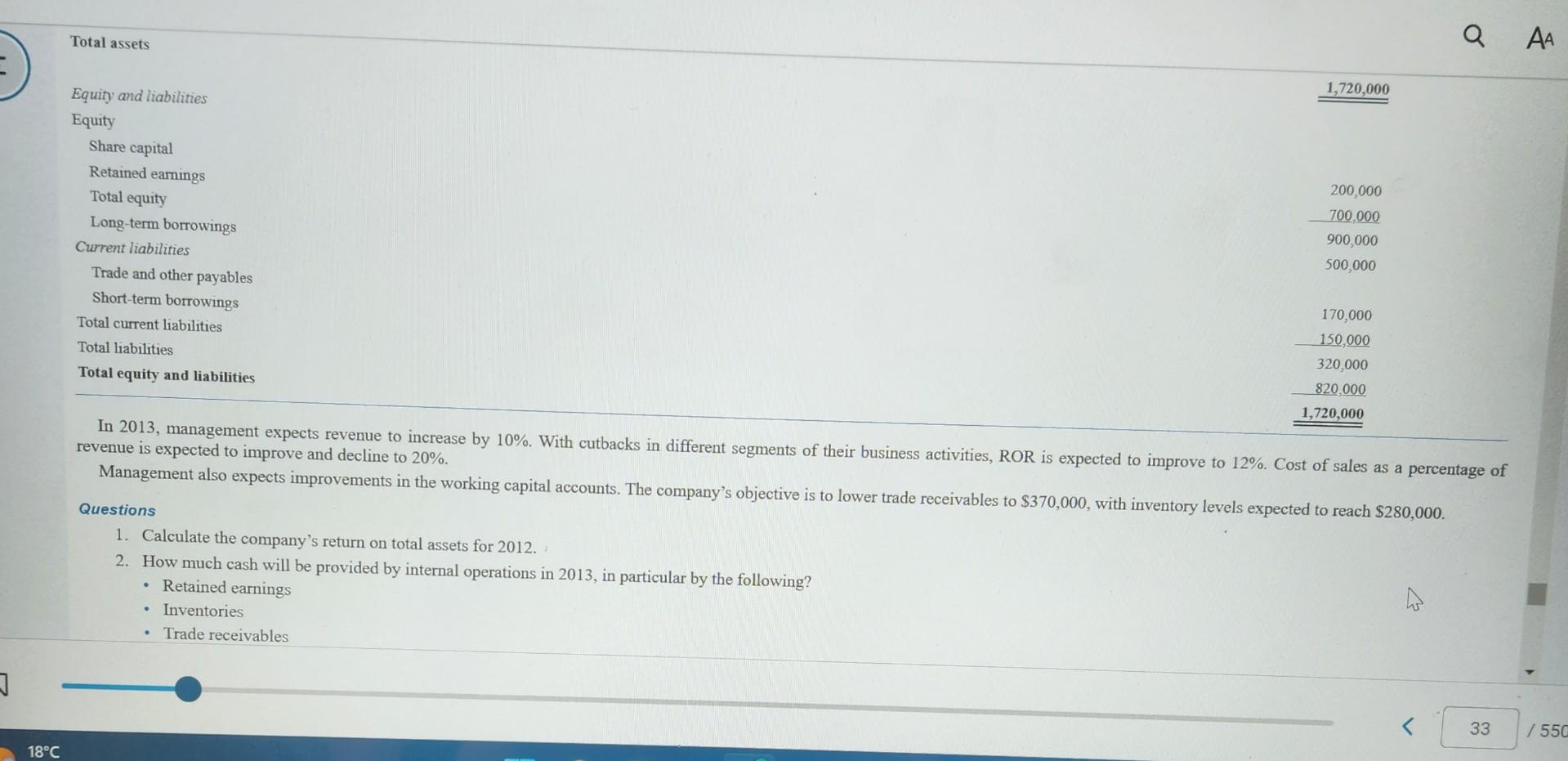

= lil 1. How much cash will be generated from internal operations by the end of 2013? 2. Will the owners have to borrow money from investors to finance the expansion? If yes, how much? Case Q A In 2013, the management committee of Packard Industries Inc. is considering investing $800,000 to purchase machinery and equipment to increase the productivity of its 33 is as follows: plant. In 2012, the company's revenue was $2,800,000, goods purchased from suppliers totalled $600,000, and the profit for the year was $280,000. The company's 2012 statement of financial position PACKARD INDUSTRIES INC. B (in S) Assets Non-current assets Current assets Inventories Trade receivables Cash and cash equivalents Total current assets Total assets 10C Packard Industries Inc. Statement of Financial Position As at December 31, 2012 1,000,000 300,000 400,000 20,000 720,000 1,720,000 32 32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts