Question: Lily, a sole trader, is considering a project A which requires an initial investment of $855 (.e., t-0). The project is expected to generate

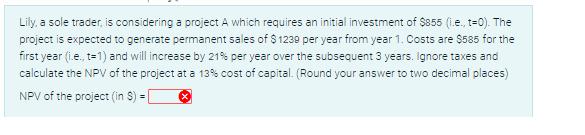

Lily, a sole trader, is considering a project A which requires an initial investment of $855 (.e., t-0). The project is expected to generate permanent sales of $1239 per year from year 1. Costs are $585 for the first year (i.e., t=1) and will increase by 21% per year over the subsequent 3 years. Ignore taxes and calculate the NPV of the project at a 13% cost of capital. (Round your answer to two decimal places) NPV of the project (in $) =

Step by Step Solution

There are 3 Steps involved in it

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts