Question: Lima Inc. can choose between two mutually exclusive projects. At the moment the company has an outstanding zero-coupon bond with face value $2,300,000 and

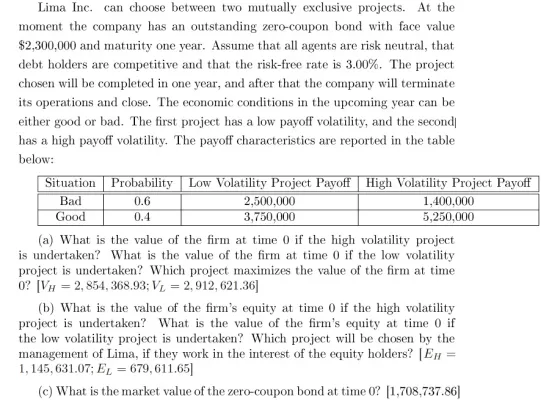

Lima Inc. can choose between two mutually exclusive projects. At the moment the company has an outstanding zero-coupon bond with face value $2,300,000 and maturity one year. Assume that all agents are risk neutral, that debt holders are competitive and that the risk-free rate is 3.00%. The project chosen will be completed in one year, and after that the company will terminate its operations and close. The economic conditions in the upcoming year can be either good or bad. The first project has a low payoff volatility, and the second] has a high payoff volatility. The payoff characteristics are reported in the table below: Situation Bad Good Probability Low Volatility Project Payoff | High Volatility Project Payoff 0.6 0.4 2,500,000 3,750,000 1,400,000 5,250,000 (a) What is the value of the firm at time 0 if the high volatility project is undertaken? What is the value of the firm at time 0 if the low volatility project is undertaken? Which project maximizes the value of the firm at time 0? [VH = 2,854, 368.93; VL = 2,912, 621.36] (b) What is the value of the firm's equity at time 0 if the high volatility project is undertaken? What is the value of the firm's equity at time 0 if the low volatility project is undertaken? Which project will be chosen by the management of Lima, if they work in the interest of the equity holders? [E = 1, 145, 631.07; EL = 679,611.65] (c) What is the market value of the zero-coupon bond at time 0? [1,708,737.86]

Step by Step Solution

3.26 Rating (149 Votes )

There are 3 Steps involved in it

a To determine the value of the firm at time 0 for each project we need to calculate the expected pa... View full answer

Get step-by-step solutions from verified subject matter experts