Question: Limitations of internal control include: A. Human error. B. Human fraud. C. Cost-benefit standard. D. All of these answers are correct A. Human error. B.

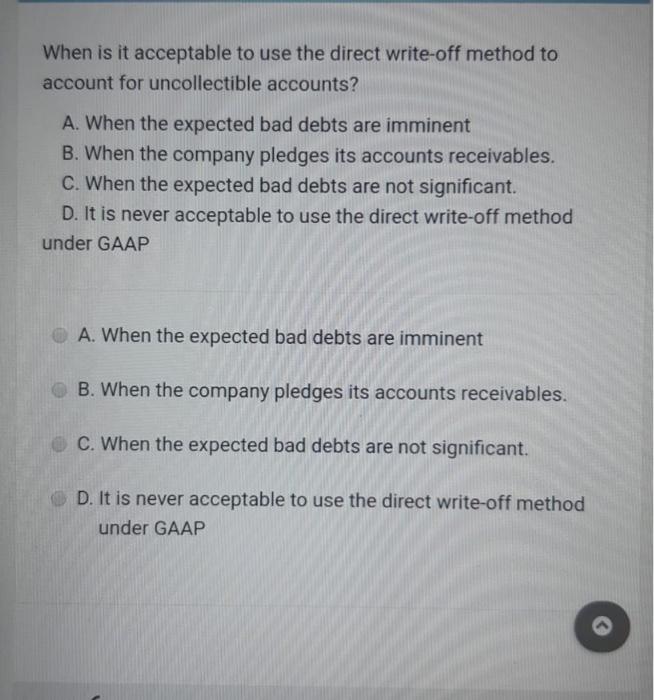

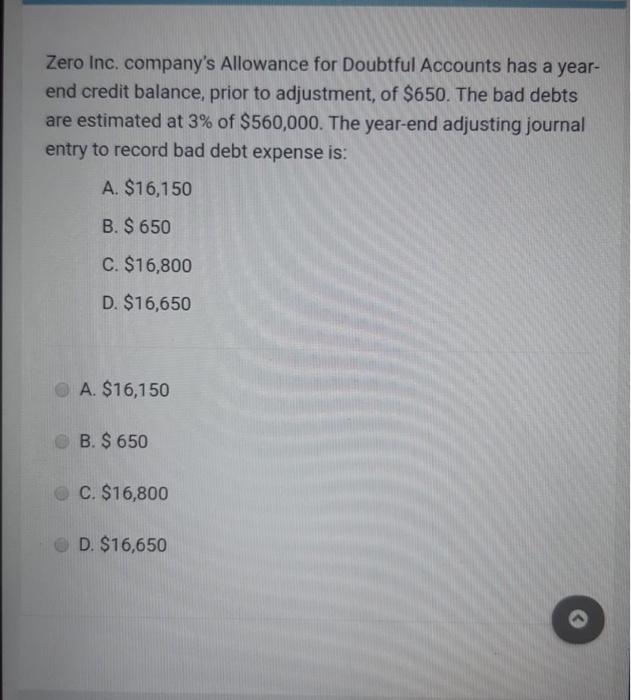

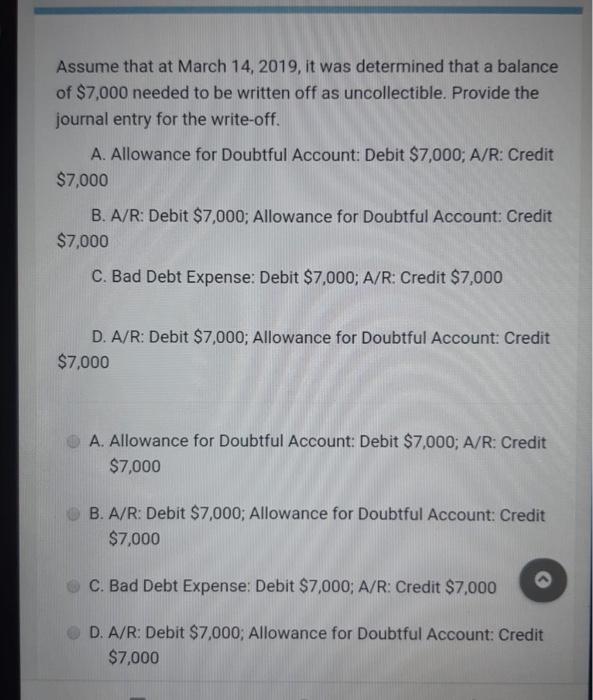

Limitations of internal control include: A. Human error. B. Human fraud. C. Cost-benefit standard. D. All of these answers are correct A. Human error. B. Human fraud. C. Cost-benefit standard. D. All of these answers are correct Z-Mart had $43 in missing petty cash receipts. The correct procedure is to: A. Debit Cash Over and Short for $43. B. Credit Cash Over and Short for $43. C. Debit Petty Cash for $43. D. Credit Petty Cash for $43. A. Debit Cash Over and Short for $43. B. Credit Cash Over and Short for $43. C. Debit Petty Cash for $43 D. Credit Petty Cash for $43. A method of estimating bad debts expense that complies with GAAP is: A. Direct write-off method. B. Income statement method. C. Aging of accounts receivable method. D. Both B and C A. Direct write-off method. B. Income statement method. C. Aging of accounts receivable method D. Both B and C Assume on December 31, ABC Inc's unadjusted trial balance included the following items: Accounts Receivable Debit balance $107,250; Allowance for Doubtful Accounts Credit balance $1,900. What amount should be debited to Bad Debt Expense, assuming 6% of outstanding accounts receivable as of December 31 is estimated to be uncollectible? A. $2,835 B. $3,755. C. $4,535 D. $6,435. A. $2,835. B. $3,755. C. $4,535 D. $6,435. When is it acceptable to use the direct write-off method to account for uncollectible accounts? A. When the expected bad debts are imminent B. When the company pledges its accounts receivables. C. When the expected bad debts are not significant. D. It is never acceptable to use the direct write-off method under GAAP A. When the expected bad debts are imminent B. When the company pledges its accounts receivables. C. When the expected bad debts are not significant. D. It is never acceptable to use the direct write-off method under GAAP Zero Inc. company's Allowance for Doubtful Accounts has a year- end credit balance, prior to adjustment, of $650. The bad debts are estimated at 3% of $560,000. The year-end adjusting journal entry to record bad debt expense is: A. $16,150 B. $ 650 C. $16,800 D. $16,650 A. $16,150 B. $ 650 C. $16,800 D. $16,650 Assume that at March 14, 2019, it was determined that a balance of $7,000 needed to be written off as uncollectible. Provide the journal entry for the write-off. A. Allowance for Doubtful Account: Debit $7,000; A/R: Credit $7,000 B. A/R: Debit $7,000; Allowance for Doubtful Account: Credit $7,000 C. Bad Debt Expense: Debit $7,000; A/R: Credit $7,000 D. A/R: Debit $7,000; Allowance for Doubtful Account: Credit $7,000 A. Allowance for Doubtful Account: Debit $7,000; A/R: Credit $7,000 B. A/R: Debit $7,000; Allowance for Doubtful Account: Credit $7,000 C. Bad Debt Expense: Debit $7,000; A/R: Credit $7,000 D. A/R: Debit $7,000; Allowance for Doubtful Account: Credit $7,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts