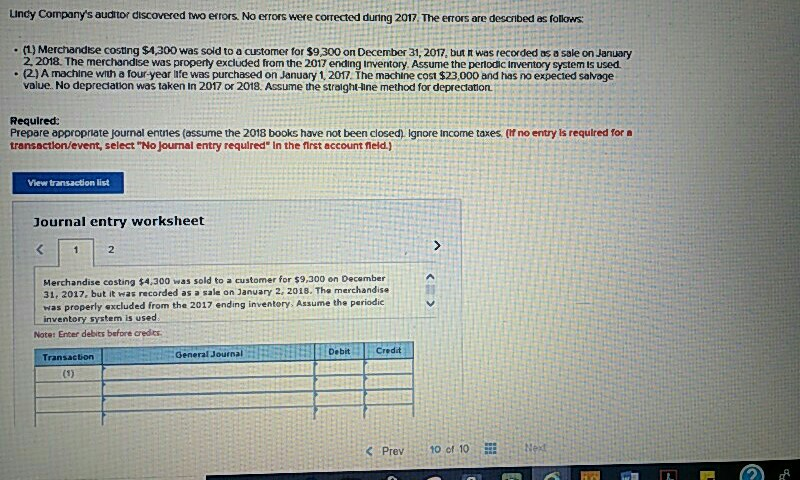

Question: Lindy Company's auditor discovered two errors. No errors were corrected during 2017. The errors are descnbed as follows: . (1) Merchandse costing $4,300 was sold

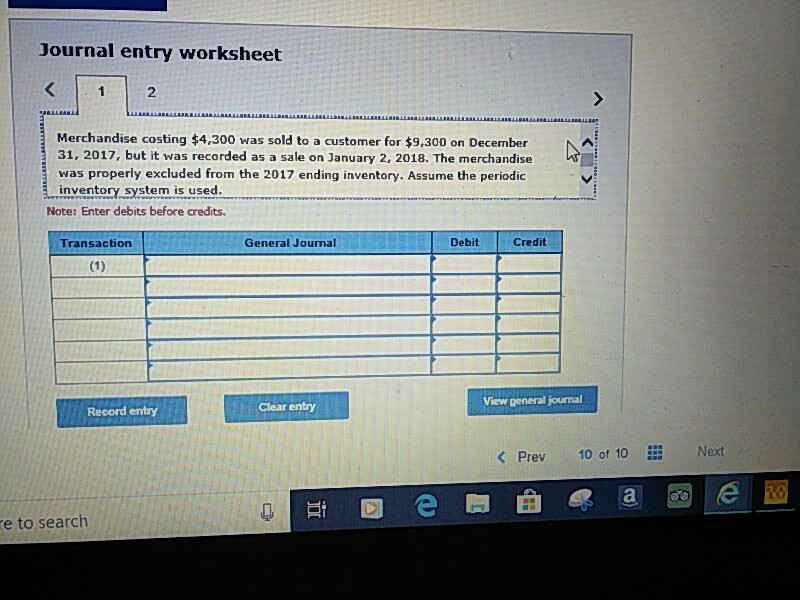

Lindy Company's auditor discovered two errors. No errors were corrected during 2017. The errors are descnbed as follows: . (1) Merchandse costing $4,300 was sold to a customer for $9,300 on December 31, 2017, but n was recorded as a sale on January 2. 2018. The merchandise was properly excluded from the 2017 ending Inventory. Assume the perlodic inventory system is used (2)A machine wih a four-year life was purchased on January 1, 2017. The machine cost $23,000 and has no expected salvage value. No depreciation was taken In 2017 or 2018. Assume the straight -ine method for deprecation Required: Prepare appropriate journal entries (assume the 2018 books have not been closed) Ignore income taxes, (If no entry is required for a transactlon/event, select "No Journal entry required" In the first account fleld.) new transaction list Journal entry worksheet 2 Merchandise costing $4.300 was sold to a customer for $9,300 on December 31, 2017, but it was recorded as a sale on January 2, 2018. The merchandise was properly excluded from the 2017 ending inventory. ssume the periodic inventory system is used Note: Enter debits before credis Genera JournalobCdd DebitCredit Transaction Journal entry worksheet 2 Merchandise costing $4,300 was sold to a customer for $9,300 on December 31, 2017, but it was recorded as a sale on January 2, 2018. The merchandise was properly excluded from the 2017 ending inventory. Assume the periodic inventory system is used Note: Enter debits before credits. Transaction General Journal Debit Credit Clear entry View peneral journal Record entry Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock