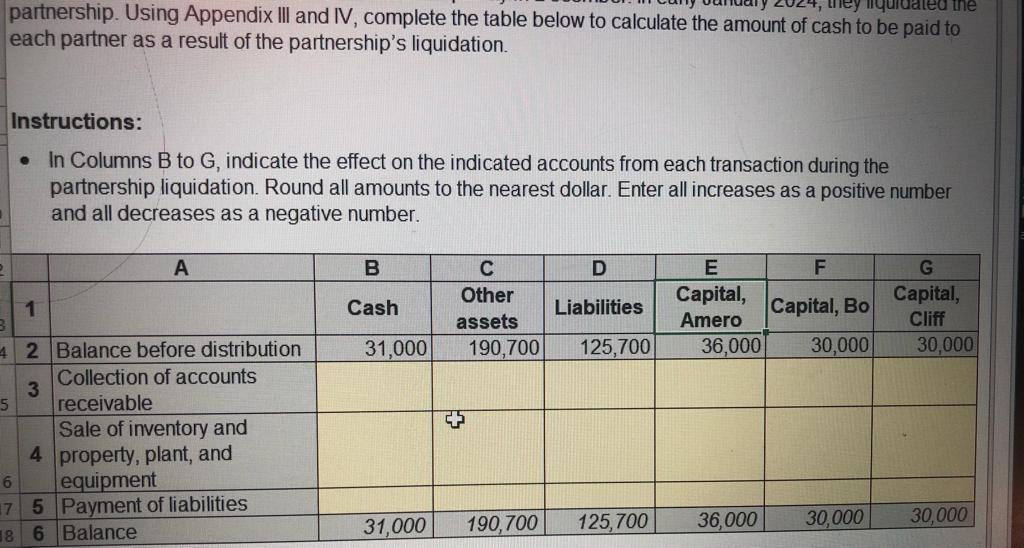

Question: liquidated the partnership. Using Appendix III and IV, complete the table below to calculate the amount of cash to be paid to each partner as

liquidated the partnership. Using Appendix III and IV, complete the table below to calculate the amount of cash to be paid to each partner as a result of the partnerships liquidation. |

Appendix IV: Notes regarding the liquidation of Amero, Bo, and Cliff Notes regarding the liquidation of Amero, Bo, and Cliff During January 2024:

There were no further operations of the business.

Accounts receivable was collected in cash for book value at December 31, 2023.

The remaining inventory and property, plant, and equipment at December 31 was sold to a competitor for $160,500 cash.

All liabilities were paid in cash for book value at December 31, 2023

please answer fill the below table

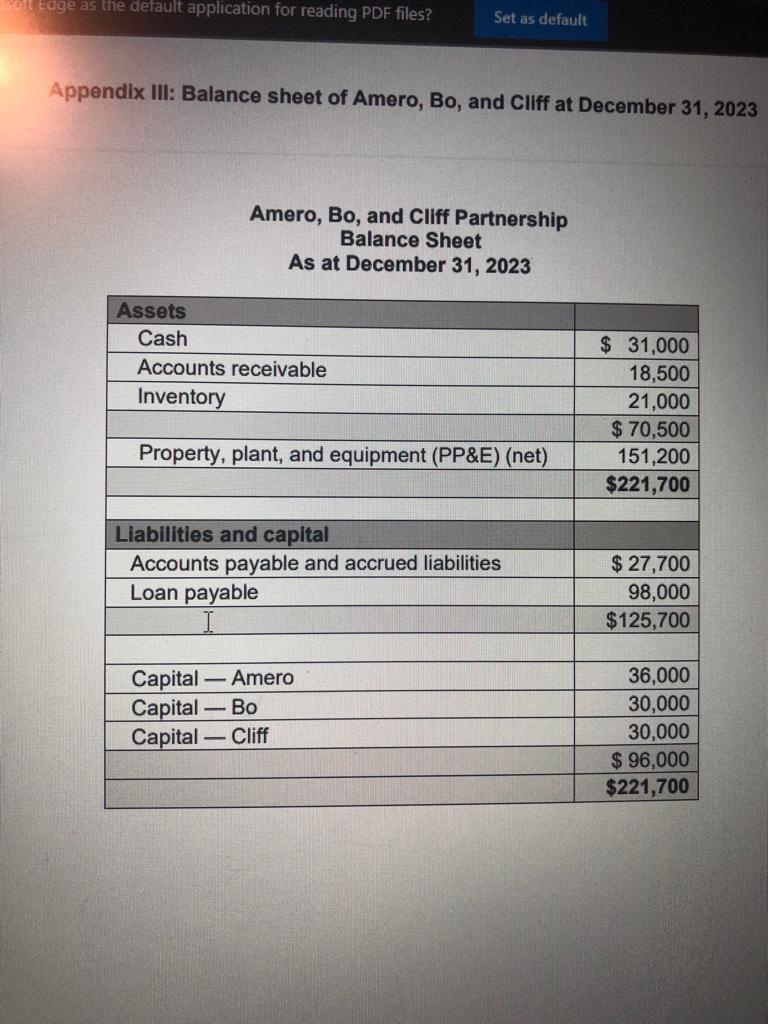

sol Edge as the default application for reading PDF files? Set as default Appendix III: Balance sheet of Amero, Bo, and Cliff at December 31, 2023 Amero, Bo, and Cliff Partnership Balance Sheet As at December 31, 2023 Assets Cash Accounts receivable Inventory $ 31,000 18,500 21,000 $ 70,500 151,200 $221,700 Property, plant, and equipment (PP&E) (net) Liabilities and capital Accounts payable and accrued liabilities Loan payable $ 27,700 98,000 $125,700 Capital Amero Capital Bo Capital Cliff 36,000 30,000 30,000 $ 96,000 $221,700 liquidated the partnership. Using Appendix III and IV, complete the table below to calculate the amount of cash to be paid to each partner as a result of the partnership's liquidation. Instructions: In Columns B to G, indicate the effect on the indicated accounts from each transaction during the partnership liquidation. Round all amounts to the nearest dollar. Enter all increases as a positive number and all decreases as a negative number. A B D 1 Cash Other assets 190,700 Liabilities E F Capital, Capital, Bo Amero 36,000 30,000 G Capital, Cliff 30,000 31,000 125,700 4 2 Balance before distribution Collection of accounts 3 5 receivable Sale of inventory and 4 property, plant, and 6 equipment 17 5 Payment of liabilities 38 6 Balance 31,000 190, 700 125, 700 36,000 30,000 30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts