Question: Liquidity Adjusted VaR (LVaR) is eectively VaR itself plus VaR of the bid/ask spread. The latter is our liquidity adjustment. It has not been introduced

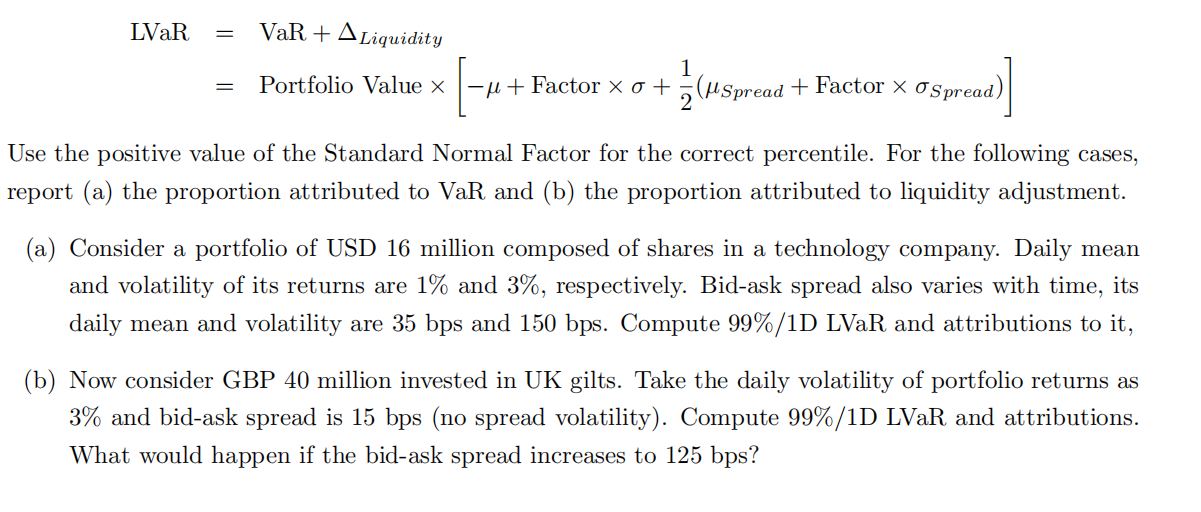

Liquidity Adjusted VaR (LVaR) is eectively VaR itself plus VaR of the bid/ask spread. The latter is our liquidity adjustment. It has not been introduced in Market Risk lecture, however to compute LVaR simply use the formula:

LVaR = VaR + ALiquidity 1-4 4 + Factor xo + 3 (HSpread + Factor x 0 Spread) 1 Portfolio Value x Use the positive value of the Standard Normal Factor for the correct percentile. For the following cases, report (a) the proportion attributed to VaR and (b) the proportion attributed to liquidity adjustment. (a) Consider a portfolio of USD 16 million composed of shares in a technology company. Daily mean and volatility of its returns are 1% and 3%, respectively. Bid-ask spread also varies with time, its daily mean and volatility are 35 bps and 150 bps. Compute 99%/1D LVaR and attributions to it, (b) Now consider GBP 40 million invested in UK gilts. Take the daily volatility of portfolio returns as 3% and bid-ask spread is 15 bps (no spread volatility). Compute 99%/1D LVaR and attributions. What would happen if the bid-ask spread increases to 125 bps? LVaR = VaR + ALiquidity 1-4 4 + Factor xo + 3 (HSpread + Factor x 0 Spread) 1 Portfolio Value x Use the positive value of the Standard Normal Factor for the correct percentile. For the following cases, report (a) the proportion attributed to VaR and (b) the proportion attributed to liquidity adjustment. (a) Consider a portfolio of USD 16 million composed of shares in a technology company. Daily mean and volatility of its returns are 1% and 3%, respectively. Bid-ask spread also varies with time, its daily mean and volatility are 35 bps and 150 bps. Compute 99%/1D LVaR and attributions to it, (b) Now consider GBP 40 million invested in UK gilts. Take the daily volatility of portfolio returns as 3% and bid-ask spread is 15 bps (no spread volatility). Compute 99%/1D LVaR and attributions. What would happen if the bid-ask spread increases to 125 bps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts