Question: List Of Accounts CLOSE Exercise 15-06 a1-b2 Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Allowance for Doubtful Accounts Bad Debt Expense Bonds Payable Buildings

List Of Accounts

CLOSE

Exercise 15-06 a1-b2

| Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Allowance for Doubtful Accounts Bad Debt Expense Bonds Payable Buildings Cash Cash Dividends Common Stock Depreciation Expense Discount on Bonds Payable Dividends Payable Equipment Gain on Bond Redemption Interest Expense Interest Payable Inventory Land Lease Liability Leased Asset-Equipment Loss on Bond Redemption Mortgage Payable Notes Payable Other Operating Expenses Paid-in Capital in Excess of Par-Common Stock Paid-in Capital in Excess of Par-Preferred Stock Preferred Stock Premium on Bonds Payable Rent Expense Rent Revenue Retained Earnings Right-of-Use-Asset Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Treasury Stock Unearned Rent Revenue |

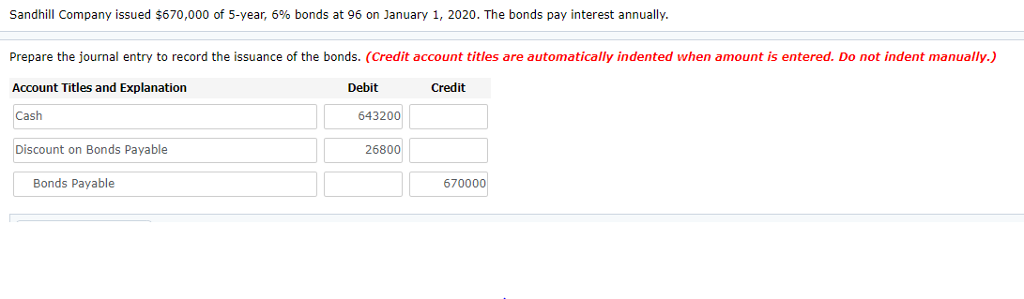

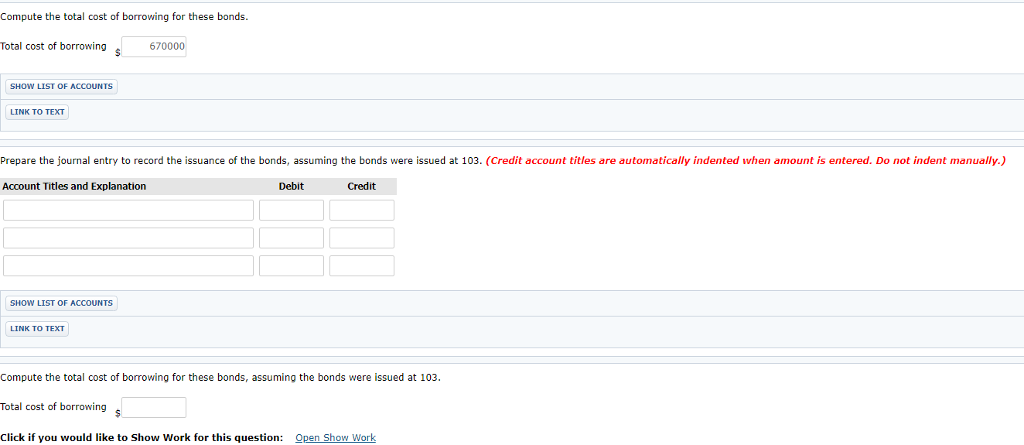

Sandhill Company issued $670,000 of 5-year, 6% bonds at 96 on January 1, 2020. The bonds pay interest annually. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Cash Discount on Bonds Payable Debit Credit 643200 26800 Bonds Payable 670000 Compute the total cost of borrowing for these bonds Total cost of borrowing 670000 SHOW LIST OF ACCOUNTS LINK TO TEXT Prepare the journal entry to record the issuance of the bonds, assuming the bonds were issued at 103. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS Compute the total cost of borrowing for these bonds, assuming the bonds were issued at 103. Total cost of borrowing Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts