Question: List the ranking you found by using each the evaluation criteria starting from payback period to Modified internal rate of return (use pay back, discounted

List the ranking you found by using each the evaluation criteria starting from payback period to Modified internal rate of return (use pay back, discounted payback, profitability Index, NPV, IRR, and MIRR based on (Wacc discount rate). How do you interpret the results based on each of six criteria?Repeat point number 3 while using the cost of capital of 9.25% and 11% respectively. Does the change in cost of capital have any impact on the ranking of the projects?

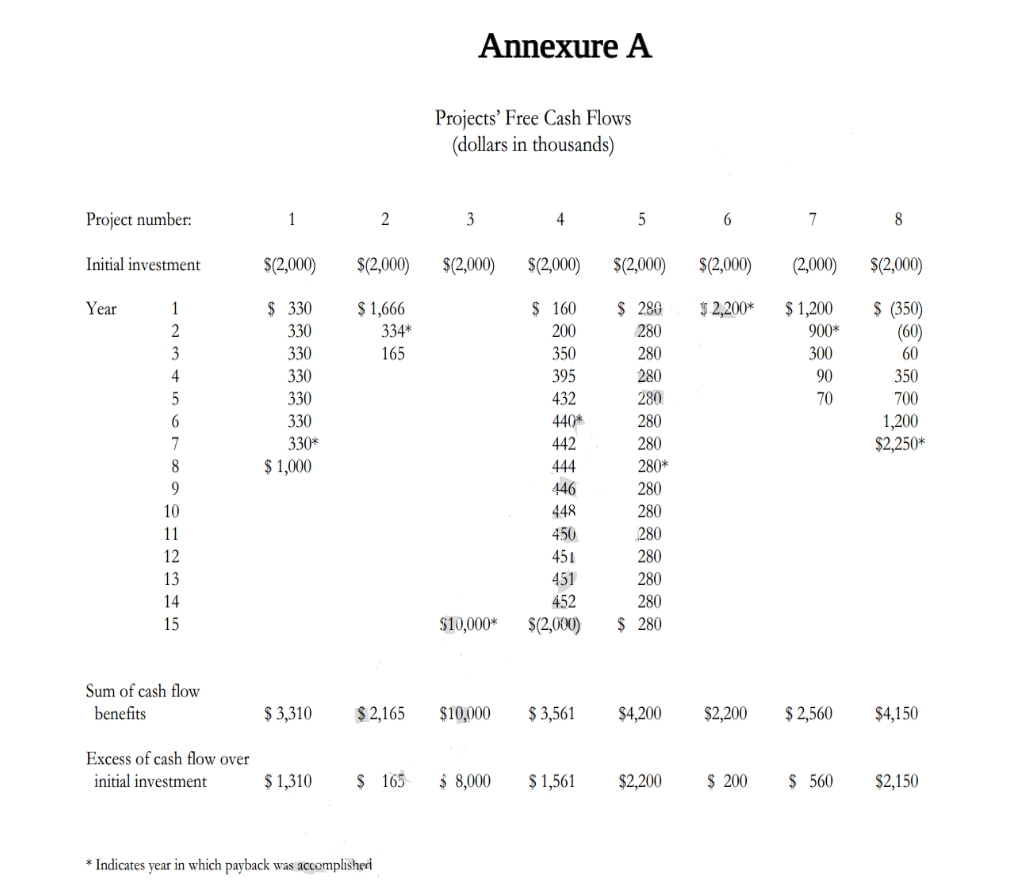

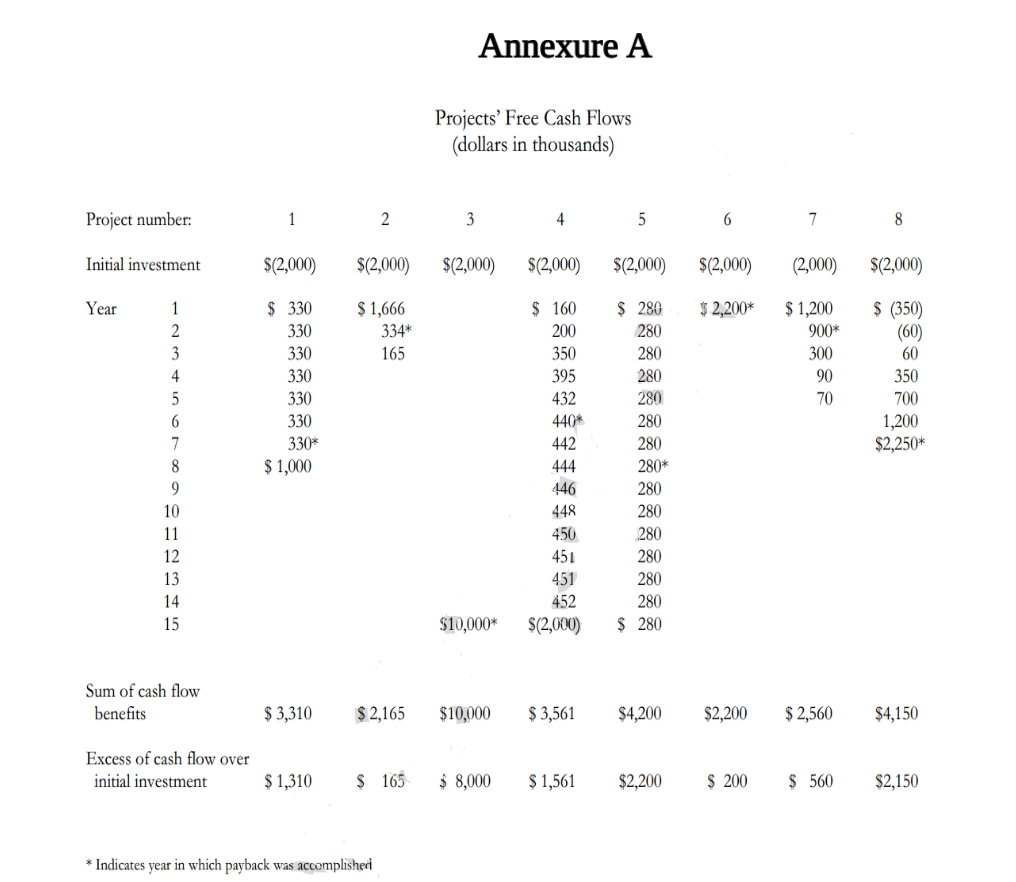

Annexure A Projects' Free Cash Flows (dollars in thousands) Project number: 2 4 5 6 7 8 Initial investment $(2,000) $(2,000) $(2,000) $(2,000) $(2,000) $(2,000) (2,000) $(2,000) Year DONQUIAWNG $ 330 $ 1,666 $ 160 $ 2,200* 330 334* $ 1,200 $ (350) 200 280 900* 330 165 (60) 350 280 330 300 60 395 280 330 90 350 432 280 330 70 700 440* 280 330* 1,200 442 280 $ 1,000 $2,250* 444 280* 10 446 280 11 448 280 450 280 12 13 451 280 14 451 280 15 452 280 $10,000* $(2,000) $ 280 Sum of cash flow benefits $ 3,310 $ 2,165 $10,000 $ 3,561 $4,200 $2,200 $ 2,560 $4,150 Excess of cash flow over initial investment $ 1,310 $ 165 $ 8,000 $ 1,561 $2,200 $ 200 $ 560 $2,150 * Indicates year in which payback was accomplished

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts