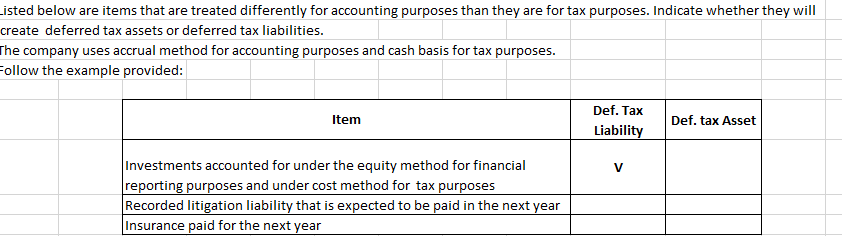

Question: Listed below are items that are treated differently for accounting purposes than they are for tax purposes. Indicate whether they will create deferred tax assets

Listed below are items that are treated differently for accounting purposes than they are for tax purposes. Indicate whether they will create deferred tax assets or deferred tax liabilities. The company uses accrual method for accounting purposes and cash basis for tax purposes. Follow the example provided: Item Def. Tax Liability Def. tax Asset V Investments accounted for under the equity method for financial reporting purposes and under cost method for tax purposes Recorded litigation liability that is expected to be paid in the next year Insurance paid for the next year Listed below are items that are treated differently for accounting purposes than they are for tax purposes. Indicate whether they will create deferred tax assets or deferred tax liabilities. The company uses accrual method for accounting purposes and cash basis for tax purposes. Follow the example provided: Item Def. Tax Liability Def. tax Asset V Investments accounted for under the equity method for financial reporting purposes and under cost method for tax purposes Recorded litigation liability that is expected to be paid in the next year Insurance paid for the next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts