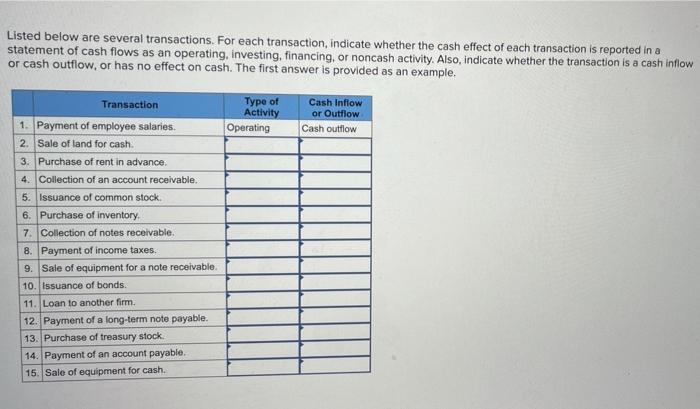

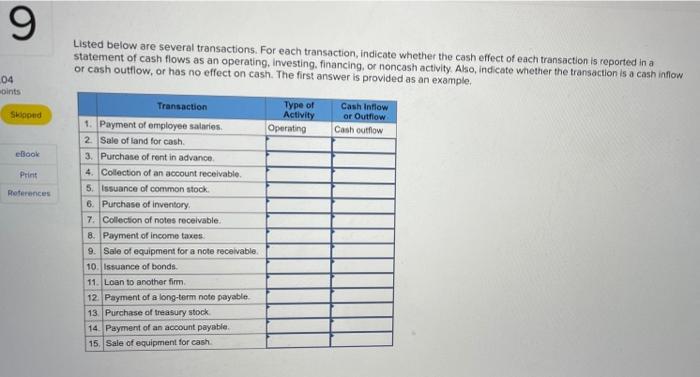

Question: Listed below are several transactions. For each transaction, indicate whether the cash effect of each transaction is reported in a statement of cash flows as

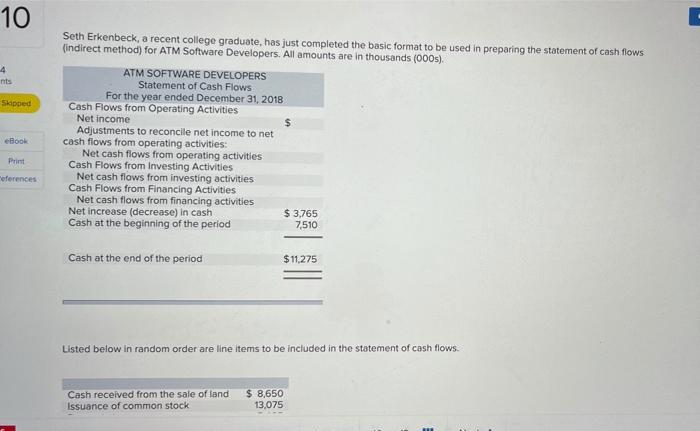

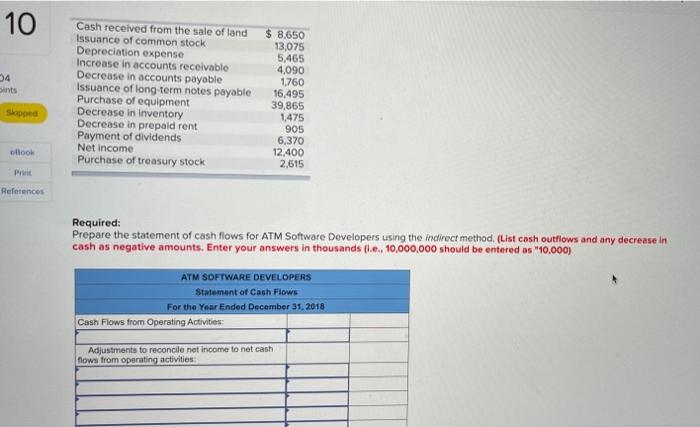

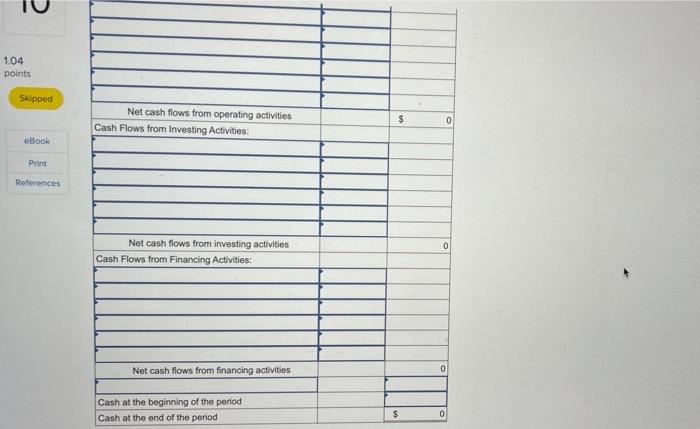

Listed below are several transactions. For each transaction, indicate whether the cash effect of each transaction is reported in a statement of cash flows as an operating, Investing, financing, or noncash activity. Also, indicate whether the transaction is a cash inflow or cash outflow, or has no effect on cash. The first answer is provided as an example, Type of Activity Operating Cash Inflow or Outfiow Cash outflow Transaction 1. Payment of employee salaries. 2. Sale of land for cash. 3. Purchase of rent in advance. 4. Collection of an account receivable. 5. Issuance of common stock 6. Purchase of inventory. 7. Collection of notes receivable. 8. Payment of income taxes. 9. Sale of equipment for a note receivable. 10. Issuance of bonds. 11. Loan to another firm. 12. Payment of a long-term note payable. 13. Purchase of treasury stock. 14. Payment of an account payable. 15. Sale of equipment for cash. 10 4 nts Skipped Seth Erkenbeck, a recent college graduate, has just completed the basic format to be used in preparing the statement of cash flows (indirect method) for ATM Software Developers. All amounts are in thousands (000s). ATM SOFTWARE DEVELOPERS Statement of Cash Flows For the year ended December 31, 2018 Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to net cash flows from operating activities: Net cash flows from operating activities Cash Flows from Investing Activities Net cash flows from investing activities Cash Flows from Financing Activities Net cash flows from financing activities Net increase (decrease) in cash $ 3,765 Cash at the beginning of the period 7,510 eBook Print oferences Cash at the end of the period $11,275 Listed below in random order are line items to be included in the statement of cash flows. Cash received from the sale of land Issuance of common stock $ 8,650 13.075 10 54 Sints Cash received from the sale of land Issuance of common stock Depreciation expense Increase in accounts receivable Decrease in accounts payable Issuance of long-term notes payable Purchase of equipment Decrease in inventory Decrease in prepaid rent Payment of dividends Net Income Purchase of treasury stock $ 8,650 13,075 5,465 4,090 1,760 16,495 39,865 1,475 905 6,370 12,400 2,615 Skipped ollook References Required: Prepare the statement of cash flows for ATM Software Developers using the Indirect method. (List cash outflows and any decrease in cash as negative amounts. Enter your answers in thousands (i... 10,000,000 should be entered as "10,000) ATM SOFTWARE DEVELOPERS Statement of Cash Flows For the Year Ended December 31, 2018 Cash Flows from Operating Activities Adjustments to reconcile net income to net cash flows from operating activities 10 1.04 points Skipped Net cash flows from operating activities Cash Flows from Investing Activities: $ 0 eBook Print References 0 Net cash flows from investing activities Cash Flows from Financing Activities: Net cash flows from financing activities 0 Cash at the beginning of the period Cash at the end of the period $ 0 9 Listed below are several transactions. For each transaction, indicate whether the cash effect of each transaction is reported statement of cash flows as an operating, Investing, financing, or noncash activity. Also, indicate whether the transaction is a cash inflow or cash outflow, or has no effect on cash. The first answer is provided as an example, a 04 oints Skloped Type of Activity Operating Cash Intlow or Outflow Cash outflow eBook Print References Transaction 1. Payment of employee salaries. 2. Sale of land for cash 3. Purchase of rent in advance 4. Collection of an account receivable 5. Issuance of common stock 6. Purchase of inventory 7. Collection of notes receivable. 8. Payment of income taxes 9. Sale of equipment for a note receivable 10. Issuance of bonds 11. Loan to another firm 12 Payment of a long-term note payable 13 Purchase of treasury stock 14. Payment of an account payable 15. Sale of equipment for cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts