Question: Listed below are various amortization methods followed by a series of descriptive statements. Match the amortization method to the statements by placing the appropriate letter

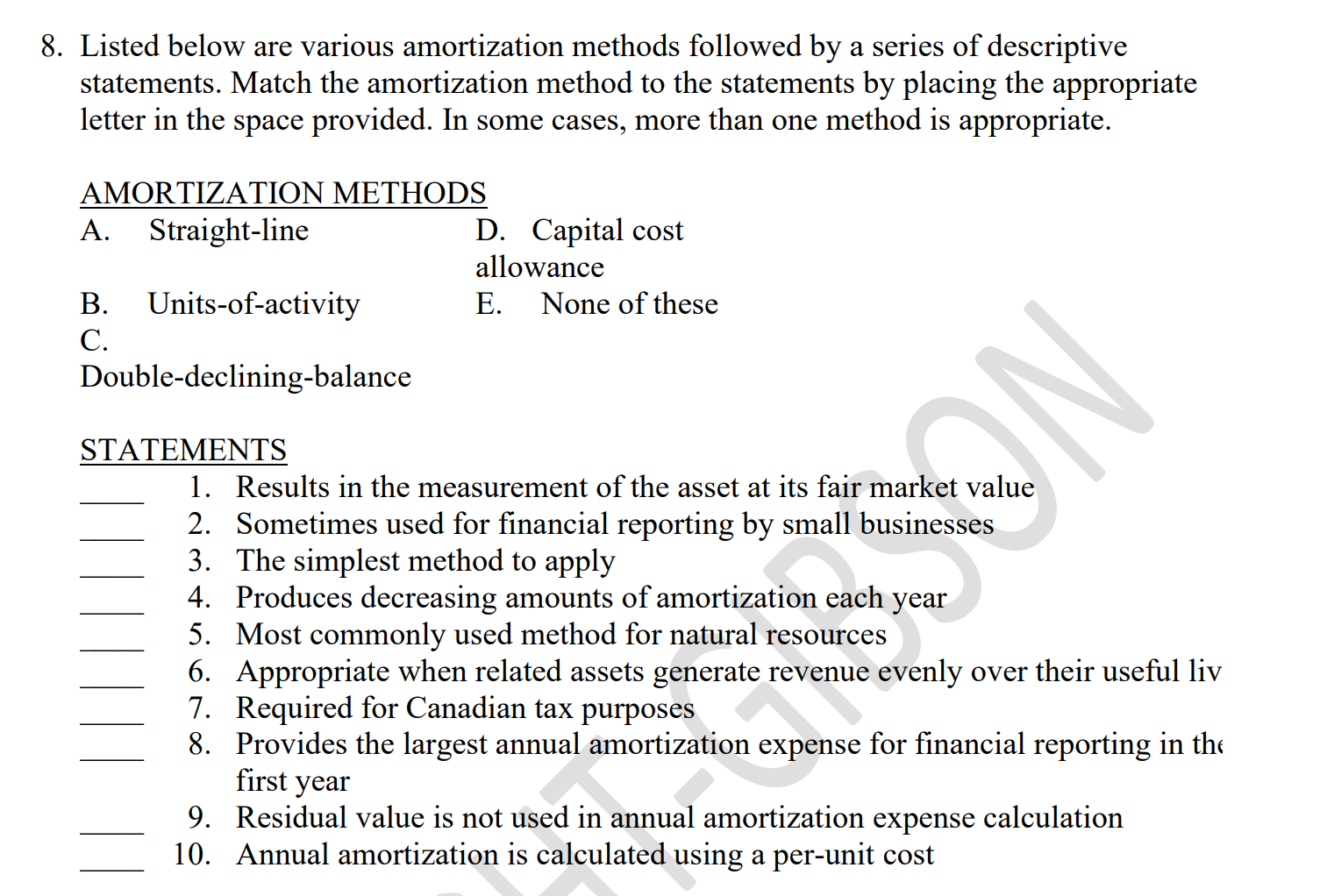

Listed below are various amortization methods followed by a series of descriptive statements. Match the amortization method to the statements by placing the appropriate letter in the space provided. In some cases, more than one method is appropriate. STATEMENTS 1. Results in the measurement of the asset at its fair market value 2. Sometimes used for financial reporting by small businesses 3. The simplest method to apply 4. Produces decreasing amounts of amortization each year 5. Most commonly used method for natural resources 6. Appropriate when related assets generate revenue evenly over their useful liv 7. Required for Canadian tax purposes 8. Provides the largest annual amortization expense for financial reporting in the first year 9. Residual value is not used in annual amortization expense calculation 10. Annual amortization is calculated using a per-unit cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts