Question: Listen (Estimated time allowance: 4 minutes) This is a partial break-even problem for price to pay for a ne equipment. You are considering replacing an

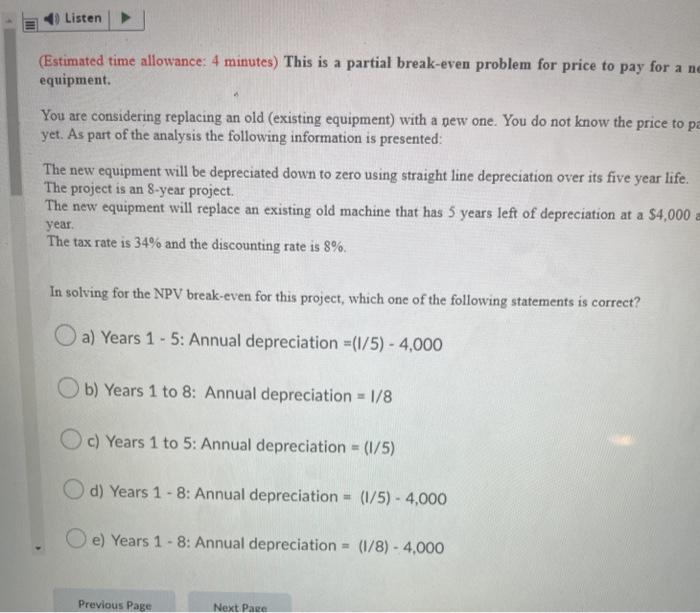

Listen (Estimated time allowance: 4 minutes) This is a partial break-even problem for price to pay for a ne equipment. You are considering replacing an old (existing equipment) with a pew one. You do not know the price to pa yet. As part of the analysis the following information is presented: The new equipment will be depreciated down to zero using straight line depreciation over its five year life. The project is an 8-year project. The new equipment will replace an existing old machine that has 5 years left of depreciation at a $4,000 year. The tax rate is 34% and the discounting rate is 8%. In solving for the NPV break-even for this project, which one of the following statements is correct? a) Years 1 - 5: Annual depreciation =(1/5) - 4,000 Ob) Years 1 to 8: Annual depreciation = 1/8 Oc) Years 1 to 5: Annual depreciation = (1/5) d) Years 1 - 8: Annual depreciation = (1/5) - 4,000 e) Years 1 - 8: Annual depreciation = (1/8) - 4,000 Previous Page Next Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts