Question: Listen Show all working, zero mark if calculations are not shown A Canadian company is looking to reduce foreign exchange rate exposures. Available in the

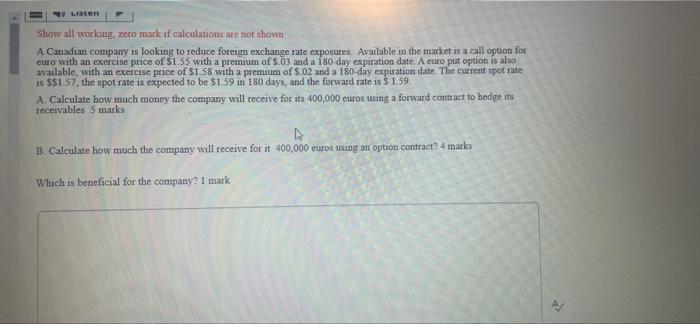

Listen Show all working, zero mark if calculations are not shown A Canadian company is looking to reduce foreign exchange rate exposures. Available in the market is a call option for euro with an exercise price of $1.55 with a premium of $.03 and a 180-day expiration date. A euro put option is also available, with an exercise price of $1.58 with a premium of $.02 and a 180-day expiration date. The current spot rate is $$1.57, the spot rate is expected to be $1.59 in 180 days, and the forward rate is $ 1.59. A. Calculate how much money the company will receive for its 400,000 euros using a forward contract to hedge its receivables 5 marks- B. Calculate how much the company will receive for it 400,000 euros using an option contract? 4 marks Which is beneficial for the company? I mark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts