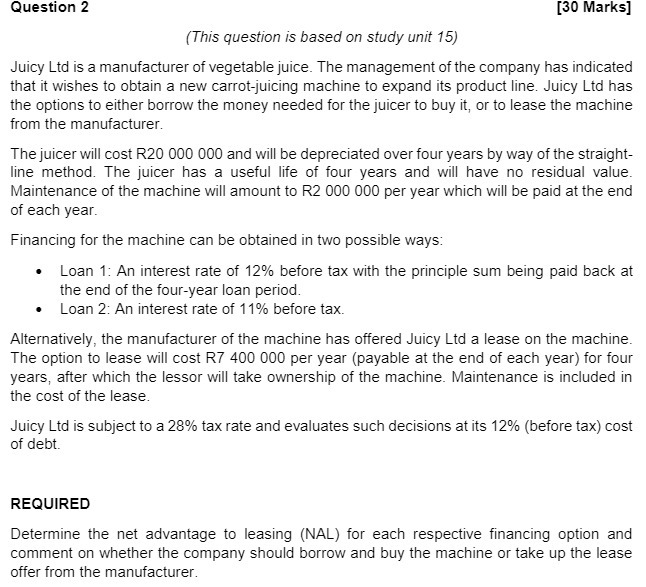

Question: lll'luestion 2 [3D Marks] {This question is based on study unit 15,! Juicy Ltd is a manufacturer of yegetablejuice. The management of the company has

![lll'luestion 2 [3D Marks] {This question is based on study unit](https://s3.amazonaws.com/si.experts.images/answers/2024/06/667b99c4346f5_323667b99c3f072f.jpg)

lll'luestion 2 [3D Marks] {This question is based on study unit 15,! Juicy Ltd is a manufacturer of yegetablejuice. The management of the company has indicated that it wishes to obtain a new carrot-juicing machine to expand its product line. Juicy Ltd has the options to either borrow the money needed for the juicer to buy it, or to lease the machine from the manufacturer. Thejuicer will cost RED [IUD EDD and will be depreciated over four years by way of the straight line method. The juicer has a useful life of four years and will have no residual yalue. Maintenance of the machine will amount to R2 DUE} DUI] per year which will be paid at the end of each year. Financing for the machine can be obtained in two possible ways: - Loan 1: An interest rate of 12% before tax with the principle sum being paid back at the end of the fouryear loan period. - Loan 2: An interest rate of 11% before tax. Altematiyely? the manufacturer of the machine has offered Juicy Ltd a lease on the machine. The option to lease will cost RT 40D DUB per year [payable at the end of each year} for four years, after which the lessor will tal-te ownership of the machine. Maintenance is included in the cost of the lease. Juicy Ltd is subject to a 23% tax rate and evaluates such decisions at its \"12% {before tax} cost of debt. REQUIRED Determine the net advantage to leasing {HAL} for each respective financing option and comment on whether the company should borrow and buy the machine or take up the lease offer from the manufacturer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts