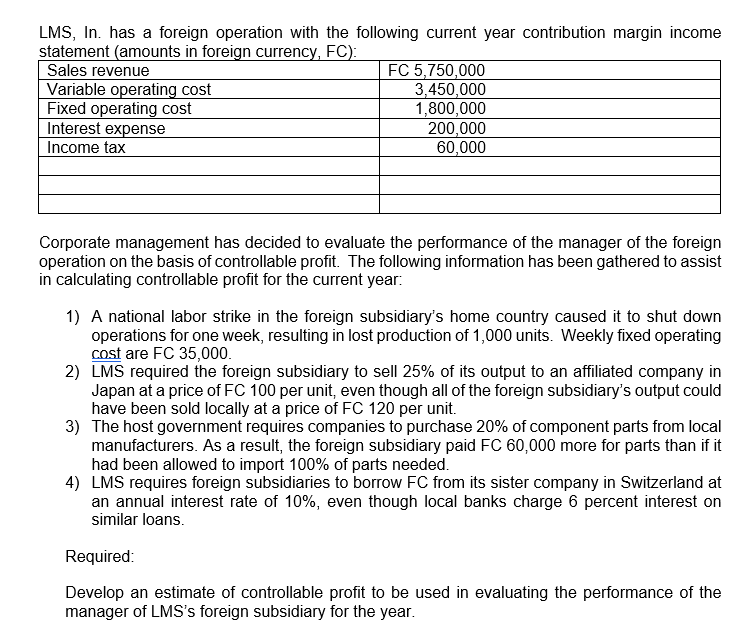

Question: LMS, In. has a foreign operation with the following current year contribution margin income statement (amounts in foreian currencv. FC): Corporate management has decided to

LMS, In. has a foreign operation with the following current year contribution margin income statement (amounts in foreian currencv. FC): Corporate management has decided to evaluate the performance of the manager of the foreign operation on the basis of controllable profit. The following information has been gathered to assist in calculating controllable profit for the current year: 1) A national labor strike in the foreign subsidiary's home country caused it to shut down operations for one week, resulting in lost production of 1,000 units. Weekly fixed operating cost are FC 35,000. 2) LMS required the foreign subsidiary to sell 25% of its output to an affiliated company in Japan at a price of FC 100 per unit, even though all of the foreign subsidiary's output could have been sold locally at a price of FC 120 per unit. 3) The host government requires companies to purchase 20% of component parts from local manufacturers. As a result, the foreign subsidiary paid FC 60,000 more for parts than if it had been allowed to import 100% of parts needed. 4) LMS requires foreign subsidiaries to borrow FC from its sister company in Switzerland at an annual interest rate of 10%, even though local banks charge 6 percent interest on similar loans. Required: Develop an estimate of controllable profit to be used in evaluating the performance of the manager of LMS's foreign subsidiary for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts