Question: lntrod uction to Microeconomics. Section II. Graphical Analysis 1. Mkt. computer programmers. The income tax break for computer programmers is rescinded. Programmers now pay the

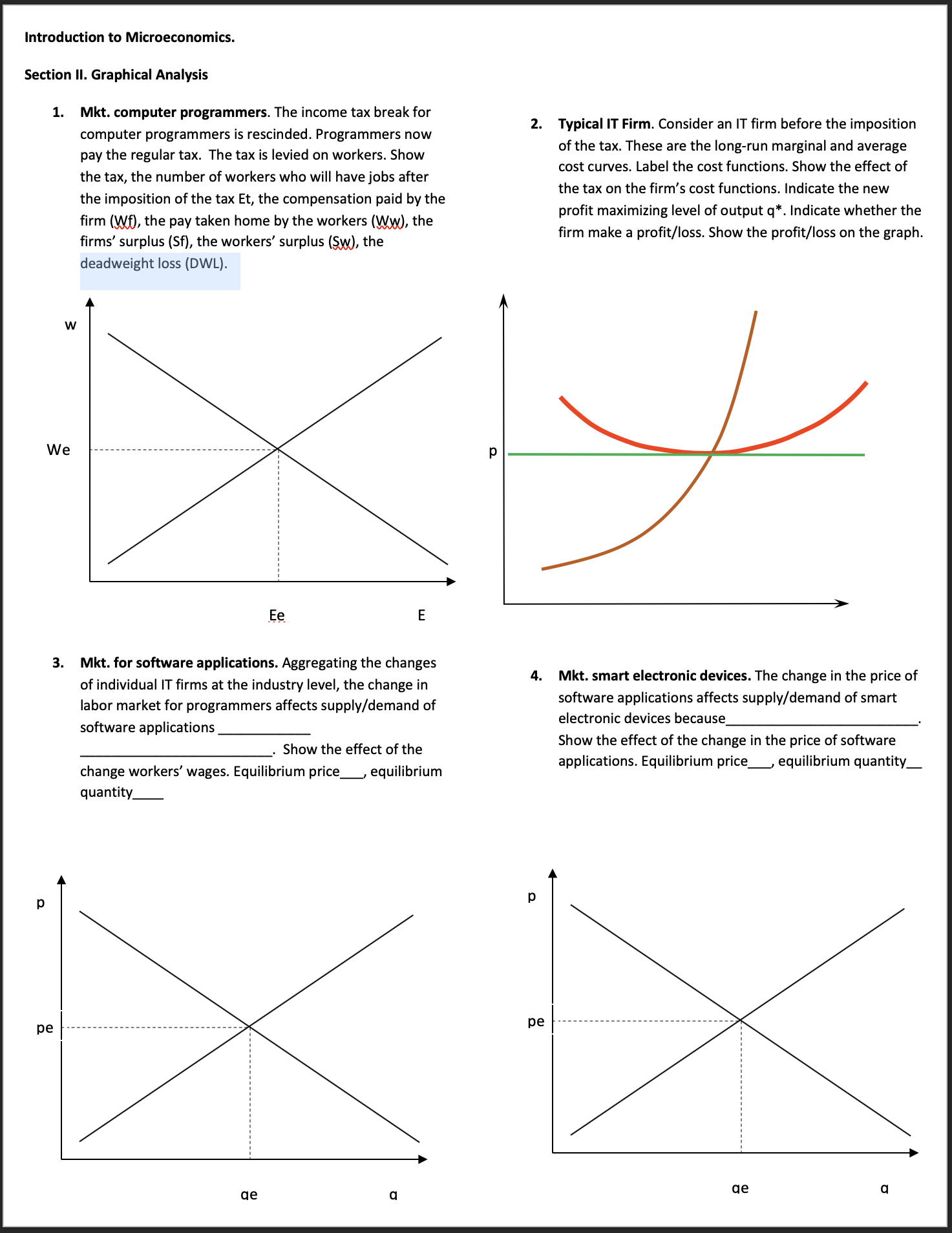

lntrod uction to Microeconomics. Section II. Graphical Analysis 1. Mkt. computer programmers. The income tax break for computer programmers is rescinded. Programmers now pay the regular tax. The tax is levied on workers. Show the tax, the number of workers who will have jobs after the imposition of the tax Et, the compensation paid by the rm (m, the pay taken home by the workers (W, the rms' surplus (Sf), the workers' surplus (5w), the deadweight loss (DWL). .Ee. Mkt. for software applications. Aggregating the changes of individual lT rms at the industry level, the change in labor market for programmers affects supply/demand of software applications . Show the effect of the change workers' wages. Equilibrium price_, equilibrium quantity Typical IT Firm. Consider an IT rm before the imposition of the tax. These are the long-run marginal and average cost curves. Label the cost functions. Show the effect of the tax on the firm's cost functions. Indicate the new profit maximizing level of output q\". Indicate whether the rm make a profit/loss. Show the profit/loss on the graph. Mkt. smart electronic devices. The change in the price of software applications affects supply/demand of smart electronic devices because Show the effect of the change in the price of software applications. Equilibrium price_, equilibrium quantity_

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts