Question: LO 1 , 5 Hedging an Existing Monetary Position On November 1 5 , Year 1 , Domco Ltd . of Montreal bought merchandise from

LO

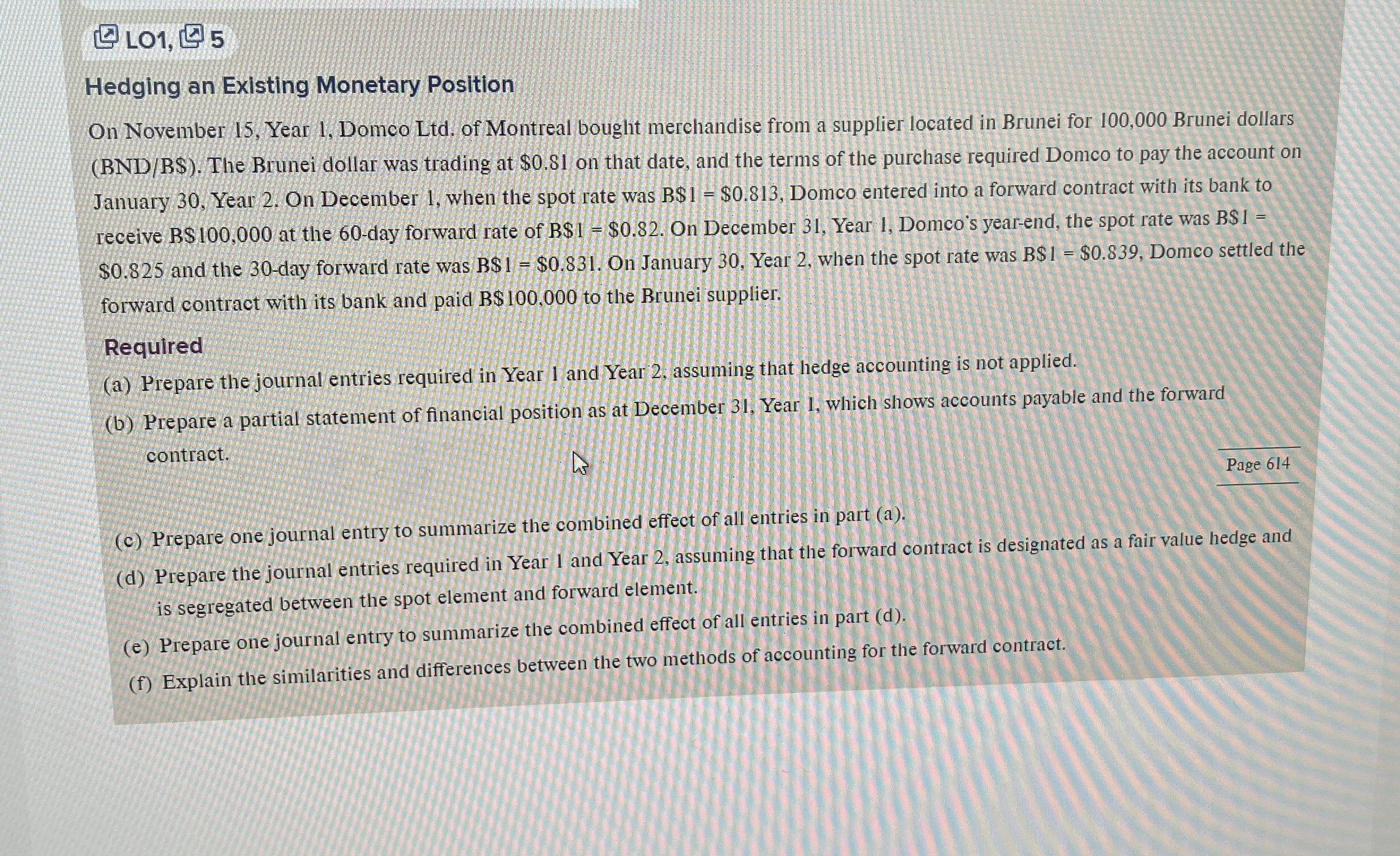

Hedging an Existing Monetary Position

On November Year Domco Ltd of Montreal bought merchandise from a supplier located in Brunei for Brunei dollars BNDB$ The Brunei dollar was trading at $ on that date, and the terms of the purchase required Domco to pay the account on January Year On December when the spot rate was $$ Domco entered into a forward contract with its bank to receive $ at the day forward rate of $$ On December Year Domco's yearend, the spot rate was B$I $ and the day forward rate was $$ On January Year when the spot rate was $$ Domco settled the forward contract with its bank and paid B $ to the Brunei supplier.

Required

a Prepare the journal entries required in Year and Year assuming that hedge accounting is not applied.

b Prepare a partial statement of financial position as at December Year which shows accounts payable and the forward contract.

c Prepare one journal entry to summarize the combined effect of all entries in part a

d Prepare the journal entries required in Year and Year assuming that the forward contract is designated as a fair value hedge and is segregated between the spot element and forward element.

e Prepare one journal entry to summarize the combined effect of all entries in part d

f Explain the similarities and differences between the two methods of accounting for the forward contract.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock