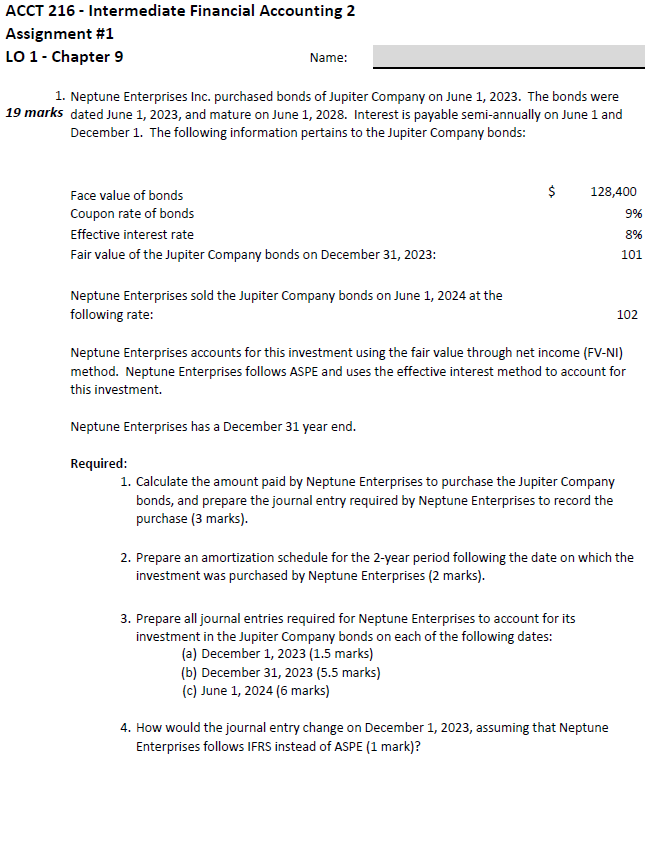

Question: LO 1 - Chapter 9 Name: 1 . Neptune Enterprises Inc. purchased bonds of Jupiter Company on June 1 , 2 0 2 3 .

LO Chapter

Name:

Neptune Enterprises Inc. purchased bonds of Jupiter Company on June The bonds were

marks dated June and mature on June Interest is payable semiannually on June and December The following information pertains to the Jupiter Company bonds:

Face value of bonds

Coupon rate of bonds

Effective interest rate quad

Fair value of the Jupiter Company bonds on December :

Neptune Enterprises sold the Jupiter Company bonds on June at the following rate:

Neptune Enterprises accounts for this investment using the fair value through net income FVNI method. Neptune Enterprises follows ASPE and uses the effective interest method to account for this investment.

Neptune Enterprises has a December year end.

Required:

Calculate the amount paid by Neptune Enterprises to purchase the Jupiter Company bonds, and prepare the journal entry required by Neptune Enterprises to record the purchase marks

Prepare an amortization schedule for the year period following the date on which the investment was purchased by Neptune Enterprises marks

Prepare all journal entries required for Neptune Enterprises to account for its investment in the Jupiter Company bonds on each of the following dates:

a December marks

b December marks

c June marks

How would the journal entry change on December assuming that Neptune Enterprises follows IFRS instead of ASPE mark

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock