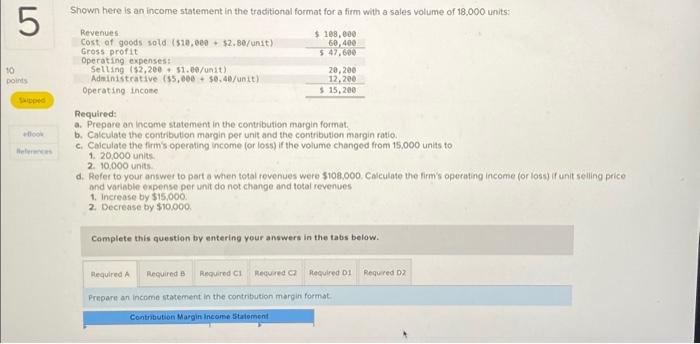

Question: LO 10 points Skipped eBook References Shown here is an income statement in the traditional format for a firm with a sales volume of 18,000

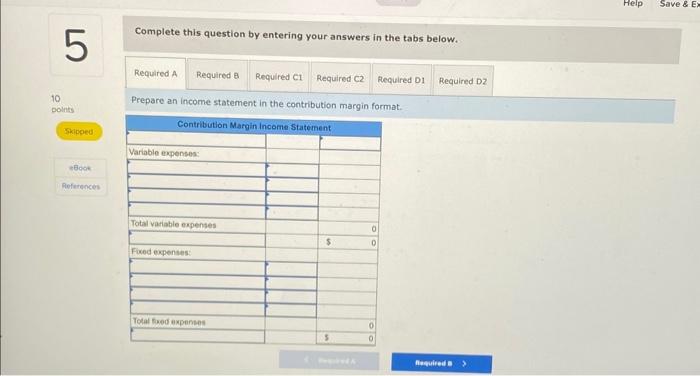

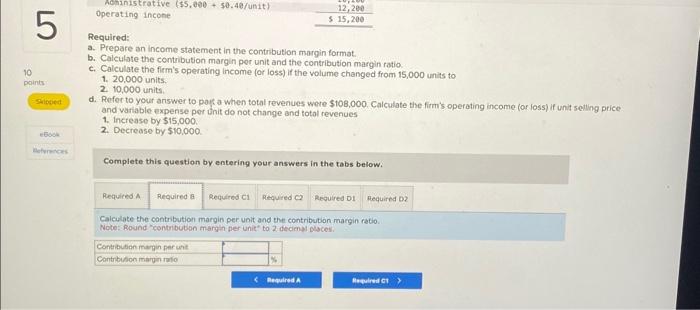

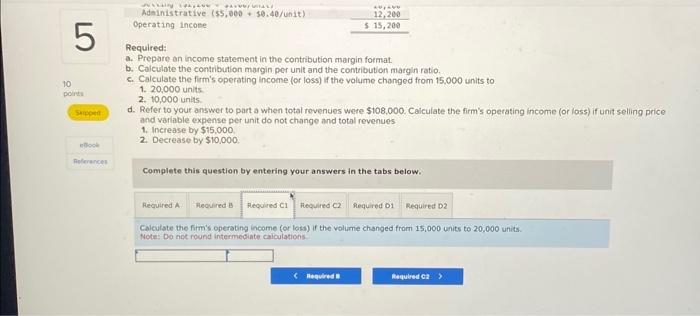

Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per unit and the contribution margin rotio. c. Caiculate the firms operating income (or loss) if the volume changed from 15,000 units to 1. 20,000 units. 210000 units: d. Aofer to your answer to part a when total revenues were $108,000. Calculate the firms operating income (or loss) if unit selling price and voriable expense per unit do not change and total revenues 1. Increase by $15.000. 2. Decrease by $10000. Complete this question by entering your answers in the tabs below. Prepare an income statement in the contribution mergin format: Complete this question by entering your answers in the tabs below. Prepare an income statement in the contribution margin format. Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per unit and the contribution margin ratia. c. Calculate the firm's operating income (or loss) if the volume changed from 15,000 units to 1. 20,000 units. 2. 10,000 units. d. Refer to your answer to poj, a when total revenues were $108,000. Calculate the firm's operating income (or loss) if unit setling price and variable expense per unit do not change and total revenues 1. Increase by $15,000. 2. Decrease by $10,000. Complete this question by entering your answers in the tabs below. Calculate the contribution margin per unit and the contribution margin ratio. Note: Round "contributan margih per unit" to 2 decimal places. Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per unit and the contribution margin ratio. c. Calculate the firm's operating income (or loss) if the volume changed from 15,000 units to 1. 20.000 units. 2. 10.000 units: d. Refer to your answer to part o when total revenues were $108,000. Calculate the firm's operating income (or loss) if unit seliling price and varlable expense per unit do not change and total revenues 1. Increose by $15,000. 2. Decrease by $10000. Complete this question by entering your answers in the tabs below. Calculate the firm's operating income (or loss) if the volume changed from 15,000 units to 10,000 units. fiote: Do not round intermediate calculations a. Prepare an income statemeot in the contribution margin format. b. Calculate the contribution margin per unit and the contribution margin ratio. c. Calculate the firm's operating income (or loss) if the volume changed from 15,000 units to 1. 20,000 units. 2. 10,000 units. d. Refer to your answer to part o when total revenues were $108,000. Calculate the firm's operating income (or loss) if unit selling price and variable expense per unit do not change and total revenues 1. Increase by $15,000. 2. Decrease by $10,000. Complete this question by entering your answers in the tabs below. Refer to your answer to part a when total revenues were $108,000, Calculate the firm's operating income (or loss) if unit seiling price and variable expense per unit do not change and total reverues decrease by $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts