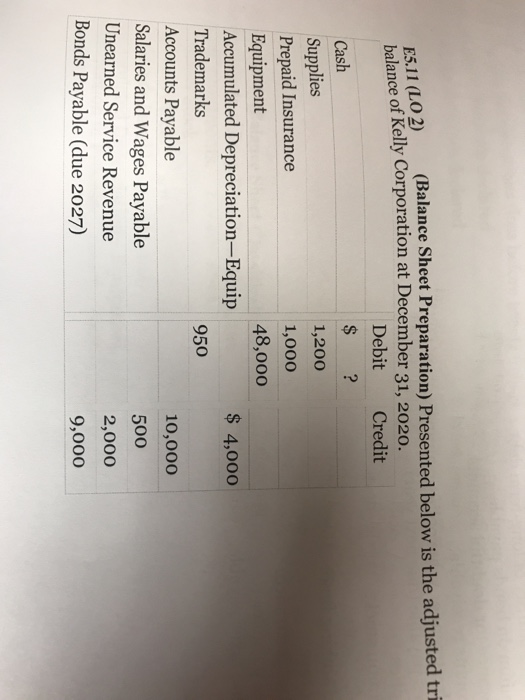

Question: LO 2) (Balance Sheet Preparation) Presented below is the adjusted tri balance of Kelly Corporation at December 31, 2020. Debit Credit Cash $ ? Supplies

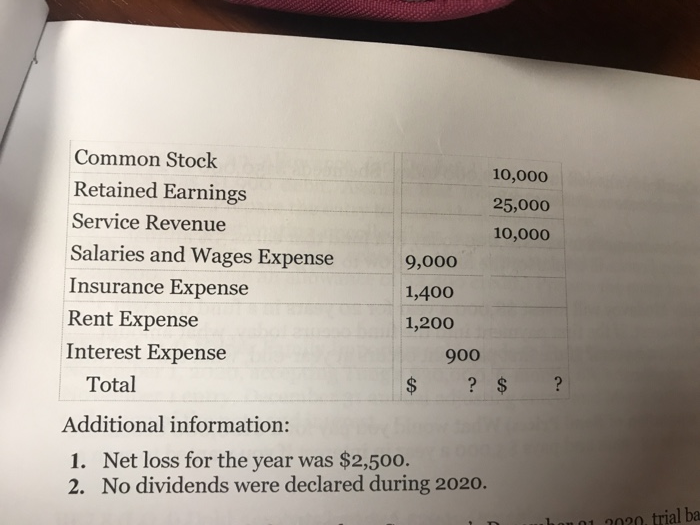

LO 2) (Balance Sheet Preparation) Presented below is the adjusted tri balance of Kelly Corporation at December 31, 2020. Debit Credit Cash $ ? Supplies 1,200 Prepaid Insurance 1,000 Equipment 48,000 Accumulated Depreciation-Equip $ 4,000 Trademarks 950 Accounts Payable 10,000 Salaries and Wages Payable 500 Unearned Service Revenue 2,000 Bonds Payable (due 2027) 9,000 Common Stock 10,000 Retained Earnings 25,000 Service Revenue 10,000 Salaries and Wages Expense 9,000 Insurance Expense 1,400 Rent Expense 1,200 Interest Expense 900 Total $ ? $ ? Additional information: 1. Net loss for the year was $2,500. 2. No dividends were declared during 2020. 101 2020. trial ba LO 2) (Balance Sheet Preparation) Presented below is the adjusted tri balance of Kelly Corporation at December 31, 2020. Debit Credit Cash $ ? Supplies 1,200 Prepaid Insurance 1,000 Equipment 48,000 Accumulated Depreciation-Equip $ 4,000 Trademarks 950 Accounts Payable 10,000 Salaries and Wages Payable 500 Unearned Service Revenue 2,000 Bonds Payable (due 2027) 9,000 Common Stock 10,000 Retained Earnings 25,000 Service Revenue 10,000 Salaries and Wages Expense 9,000 Insurance Expense 1,400 Rent Expense 1,200 Interest Expense 900 Total $ ? $ ? Additional information: 1. Net loss for the year was $2,500. 2. No dividends were declared during 2020. 101 2020. trial ba

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts