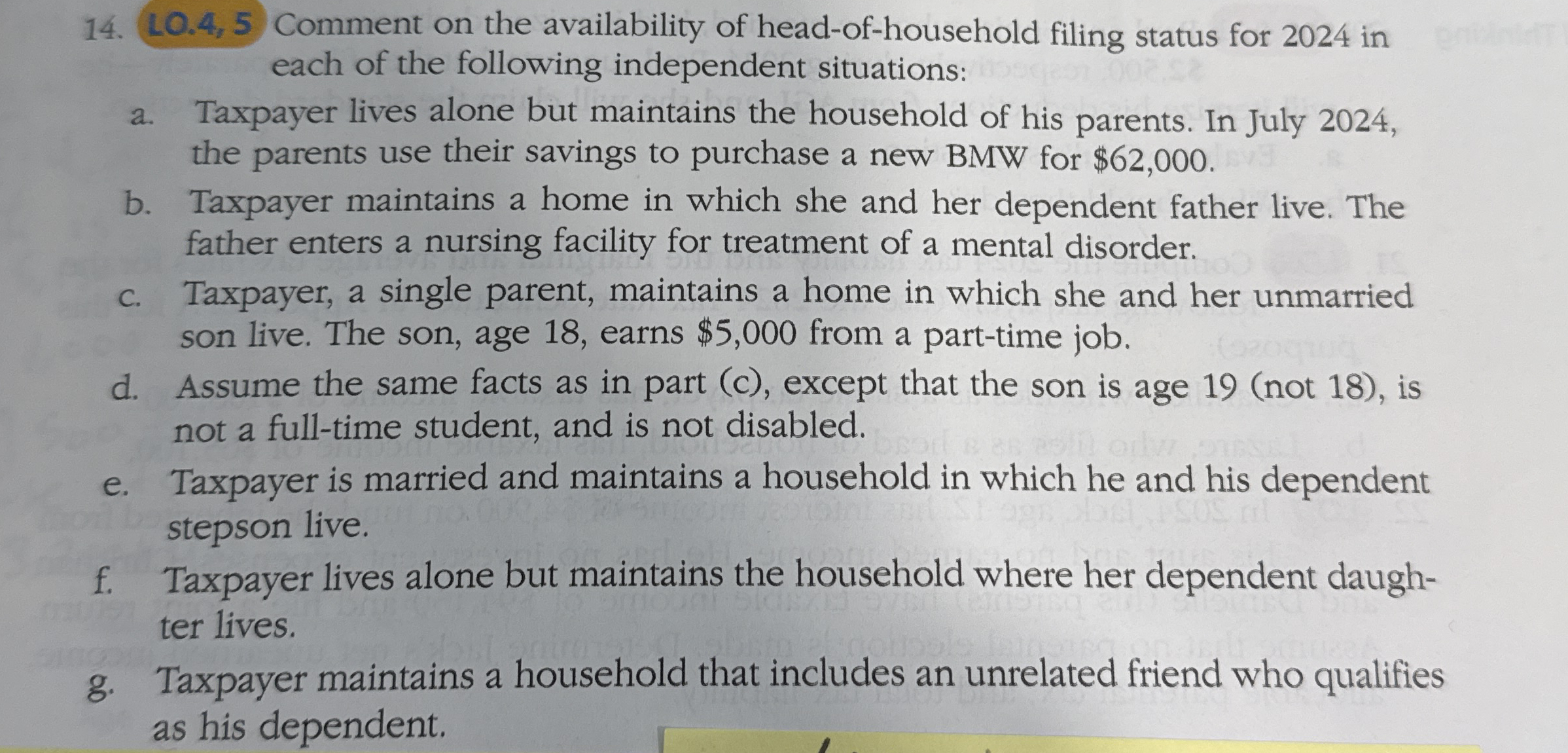

Question: LO . 4 , 5 Comment on the availability of head - of - household filing status for 2 0 2 4 in each of

LO Comment on the availability of headofhousehold filing status for in

each of the following independent situations:

a Taxpayer lives alone but maintains the household of his parents. In July

the parents use their savings to purchase a new BMW for $

b Taxpayer maintains a home in which she and her dependent father live. The

father enters a nursing facility for treatment of a mental disorder.

c Taxpayer, a single parent, maintains a home in which she and her unmarried

son live. The son, age earns $ from a parttime job.

d Assume the same facts as in part c except that the son is age not is

not a fulltime student, and is not disabled.

e Taxpayer is married and maintains a household in which he and his dependent

stepson live.

f Taxpayer lives alone but maintains the household where her dependent daugh

ter lives.

g Taxpayer maintains a household that includes an unrelated friend who qualifies

as his dependent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock