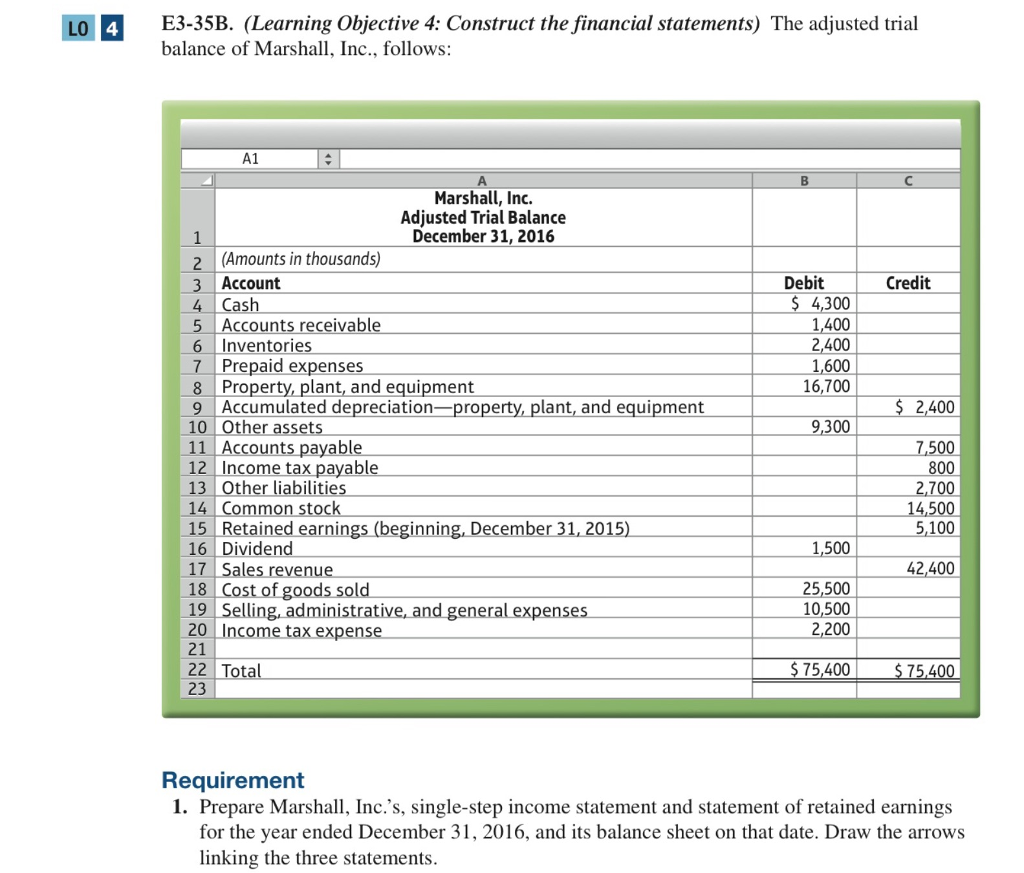

Question: LO 4E3-35B. (Learning Objective 4: Construct the financial statements) The adjusted trial balance of Marshall, Inc., follows A1 Marshall, Inc. Adjusted Trial Balance December 31,

LO 4E3-35B. (Learning Objective 4: Construct the financial statements) The adjusted trial balance of Marshall, Inc., follows A1 Marshall, Inc. Adjusted Trial Balance December 31, 2016 2 (Amounts in thousands) 3 Account 4 Debit Credit 4,300 1,400 2,400 1,600 16,700 un vabl 6 Inventorie Prepaid expense 8 Property, plant, and equipment 9 Accumulated depreciation--property, plant, and equipment 10 2,400 9,300 12 Income tax payable 13 14 15 16 100 1,500 42,400 19Selling, administrative, and gen 20 21 25,500 10,500 2,200 me tax expense 75,400 23 Requirement 1. Prepare Marshall, Inc.'s, single-step income statement and statement of retained earnings for the year ended December 31,2016, and its balance sheet on that date. Draw the arrows linking the three statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts