Question: LO10-8 EXERCISE 10.15 Examining Home Depot's Capital Structure To answer the following questions use the financial statements for Home Depot, Inc., in Appendix A at

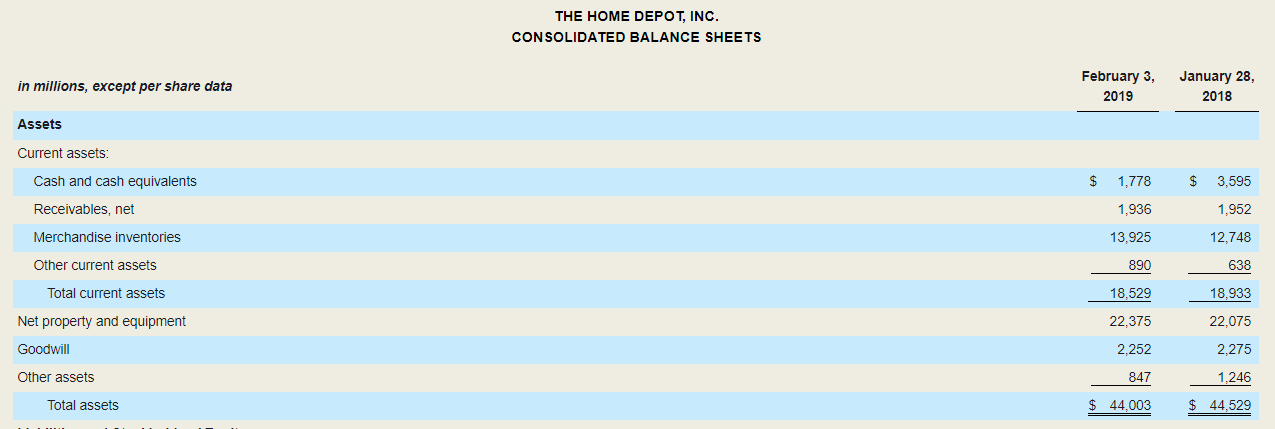

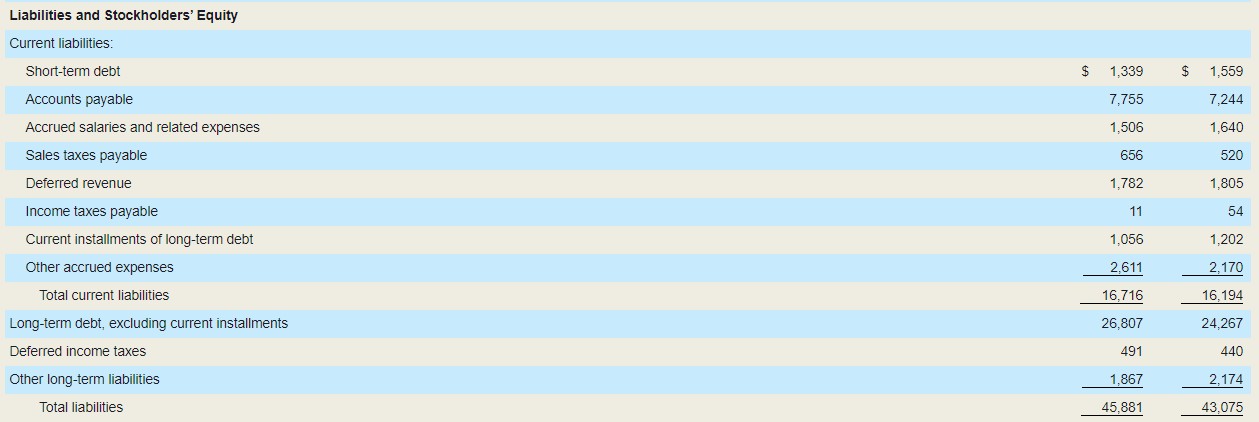

LO10-8 EXERCISE 10.15 Examining Home Depot's Capital Structure To answer the following questions use the financial statements for Home Depot, Inc., in Appendix A at the end of the textbook. a. Compute the company's current ratio and quick ratio for the most recent year reported. Do these ratios provide support that Home Depot is able to repay its current liabilities as they come due? Explain. b. Compute the company's debt ratio. Does Home Depot appear to have excessive debt? Has the company successfully employed leverage? c. Examine the company's statement of cash flows. Does Home Depot's cash flow from operating activities appear adequate to cover its current liabilities as they come due? Explain. THE HOME DEPOT, INC. CONSOLIDATED BALANCE SHEETS in millions, except per share data February 3, 2019 January 28, 2018 Assets Current assets: Cash and cash equivalents $ 1,778 $ 3,595 Receivables, net 1,936 1,952 Merchandise inventories 13,925 12,748 Other current assets 890 638 Total current assets 18,529 18,933 Net property and equipment 22,375 22,075 Goodwill 2.252 2,275 Other assets 847 1,246 Total assets $ 44.003 $ 44.529 Liabilities and Stockholders' Equity Current liabilities: Short-term debt $ 1,339 $ 1,559 Accounts payable 7,755 7,244 Accrued salaries and related expenses 1,506 1,640 Sales taxes payable 656 520 Deferred revenue 1.782 1.805 11 54 Income taxes payable Current installments of long-term debt 1,056 1,202 Other accrued expenses 2,611 2,170 Total current liabilities 16,716 16.194 Long-term debt, excluding current installments 26,807 24,267 Deferred income taxes 491 440 Other long-term liabilities 1.867 2,174 Total liabilities 45,881 43,075

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts