Question: LO2 14. Project Evaluation Kolby's Korndogs is looking at a new sausage system with an installed cost of $655,000. This cost will be depreciated straight-line

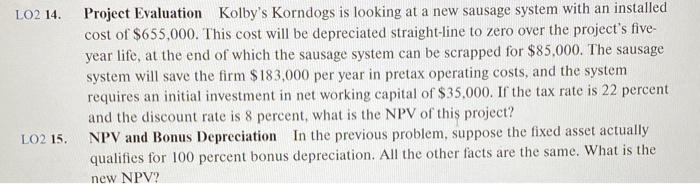

LO2 14. Project Evaluation Kolby's Korndogs is looking at a new sausage system with an installed cost of $655,000. This cost will be depreciated straight-line to zero over the project's fiveyear life, at the end of which the sausage system can be scrapped for $85,000. The sausage system will save the firm $183,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $35,000. If the tax rate is 22 percent and the discount rate is 8 percent, what is the NPV of this project? LO2 15. NPV and Bonus Depreciation In the previous problem, suppose the fixed asset actually qualifies for 100 percent bonus depreciation. All the other facts are the same. What is the new NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts