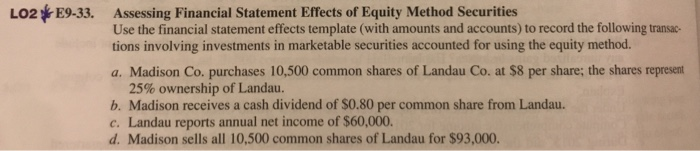

Question: LO2E9-33. Assessing Financial Statement Effects of Equity Method Securities Use the financial statement effects template (with amounts and accounts) to record the following transac- tions

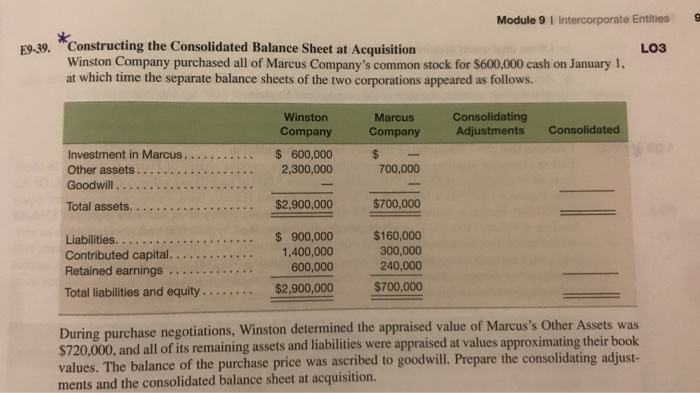

LO2E9-33. Assessing Financial Statement Effects of Equity Method Securities Use the financial statement effects template (with amounts and accounts) to record the following transac- tions involving investments in marketable securities accounted for using the equity method. a. Madison Co. purchases 10,500 common shares of Landau Co. at $8 per share; the shares represent 25% ownership of Landau. b. Madison receives a cash dividend of $0.80 per common share from Landau. c. Landau reports annual net income of $60,000. d. Madison sells all 10,500 common shares of Landau for $93,000. Module 9 1 Intercorporate Entities E.39. Constructing the Consolidated Balance Sheet at Acquisition LO3 Winston Company purchased all of Marcus Company's common stock for $600,000 cash on January 1, at which time the separate balance sheets of the two corporations appeared as follows. Winston Company Marcus Company Consolidating Adjustments Consolidated Other assets. ..2,300,000 700,000 Goodwill. Total assets.. Liabilities $700,000 1,400,000 600,000 300,000 240,000 $700,000 Total liabilities and equity... During purchase negotiations, Winston determined the appraised value of Marcus's O S720,000, and all of its remaining assets and liabilities were appraised at values approximating their boolk values. The balance of the purchase price was ascribed to goodwill. Prepare the ments and the consolidated balance sheet at acquisition. ther Assets was consolidating adjust

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts