Question: LO3,5 E11.4 Prepare a statement of cash flows (direct method), and calculate cash-based ratios. Here is a statement of financial position for Big Bang Balloons

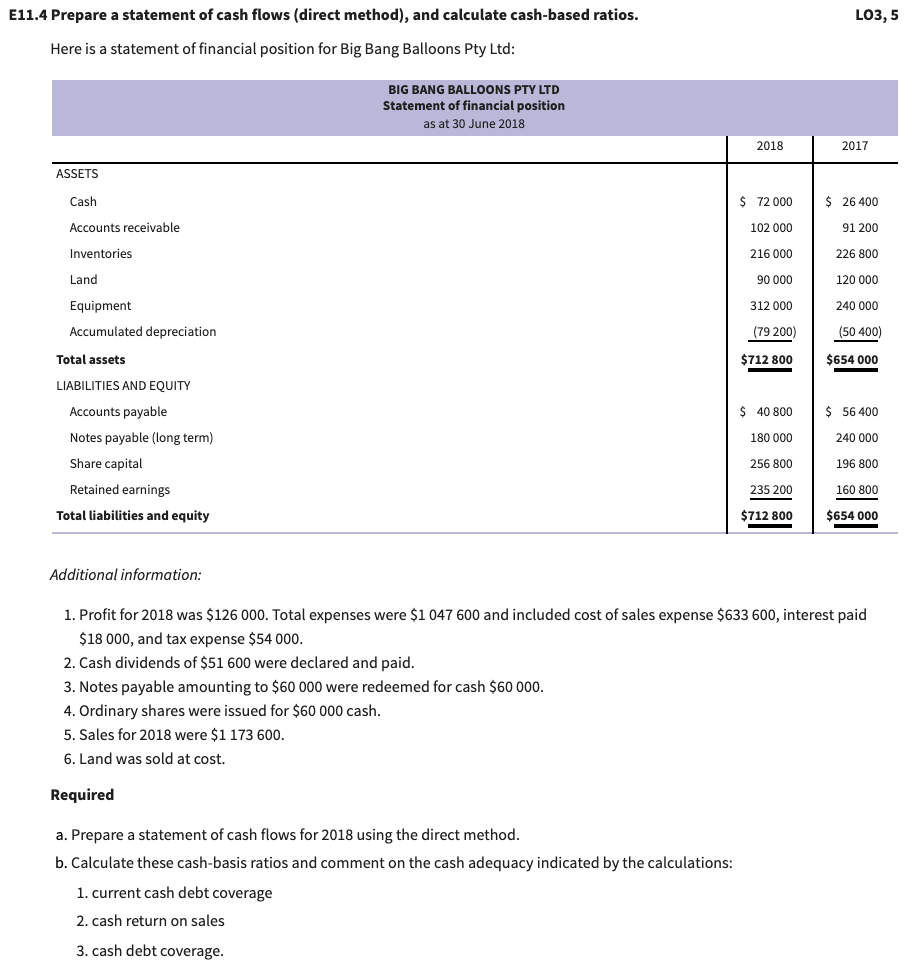

LO3,5 E11.4 Prepare a statement of cash flows (direct method), and calculate cash-based ratios. Here is a statement of financial position for Big Bang Balloons Pty Ltd: BIG BANG BALLOONS PTY LTD Statement of financial position as at 30 June 2018 2018 2017 ASSETS Cash $ 72 000 $ 26 400 Accounts receivable 102 000 91 200 Inventories 216 000 226 800 Land 90 000 120 000 312 000 240 000 Equipment Accumulated depreciation (79 200) (50 400) Total assets $712 800 $654 000 LIABILITIES AND EQUITY $ 40 800 $ 56 400 Accounts payable Notes payable (long term) 180 000 240 000 Share capital 256 800 196 800 235 200 160 800 Retained earnings Total liabilities and equity $712 800 $654 000 Additional information: 1. Profit for 2018 was $126 000. Total expenses were $1 047 600 and included cost of sales expense $633 600, interest paid $18 000, and tax expense $54 000. 2. Cash dividends of $51 600 were declared and paid. 3. Notes payable amounting to $60 000 were redeemed for cash $60 000. 4. Ordinary shares were issued for $60 000 cash. 5. Sales for 2018 were $1 173 600. 6. Land was sold at cost. Required a. Prepare a statement of cash flows for 2018 using the direct method. b. Calculate these cash-basis ratios and comment on the cash adequacy indicated by the calculations: 1. current cash debt coverage 2. cash return on sales 3. cash debt coverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts